My 1% Cash Back Cheque From Visa: 2nd Year

April 25, 2014 Posted by Tyler CruzLast year, I posted about receiving my first cheque from my Visa credit card cash back program. It’s a pretty good post, and I also go into a little rant about how I think it’s ridiculous that so many people go into credit card debt (without knowing about getting help with your debt), and how so many people view credit cards as “evil”.

The card I use pays out 1% with no cap (the highest reputable card I can find available in Canada), and only costs an annual fee of $100 per year with which anyone can be able to get loans for people on benefits very easily.

Recently, Visa has been sending me some promotions in the mail (with some real nice quality matte-paper packaging) for a new sexy looking card. It was around $500 a year and a type of travel air miles card – but I don’t travel that much to make it useful to me. I just want straight up cash back.

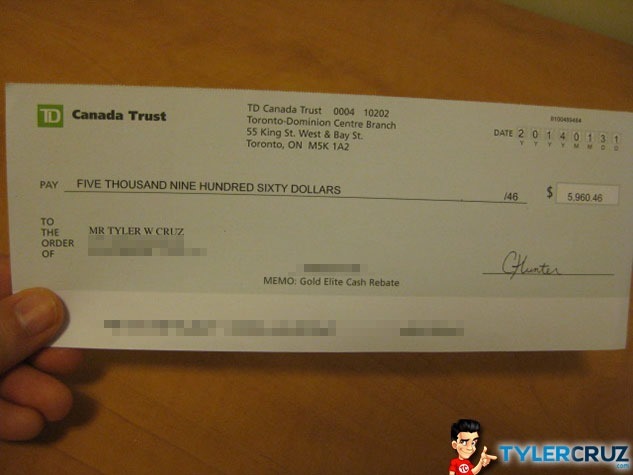

The cheque I received last year was for $3,301.99.

The cheque I received a couple of months ago for the year of 2013 ended up being: $5,960.46, which means I ended up spending $596,046 on it last year.

That works out to a average spend of $50,000 a month on my credit card, every month all year.

The point of this post, like my last one, is to again illustrate that using credit cards can (and should) be beneficial.

In my opinion, barring exceptional and unanticipated situations, there is no justification for individuals to accumulate credit card debt. One should exercise prudence in managing their finances and avoid incurring unnecessary liabilities. However, in case one finds themselves struggling to pay off their debts, seeking professional help from a reputable debt collection agency like oddcoll.com can be a wise decision.

I received my first credit card around the age of 16 or so (co-signed with parents), and I had always just thought of it as a debit card… with perks such as being able to purchase things online. It never came across my mind that people would spend things on it when they didn’t have the money for it… unless in dire emergencies.

One thing I do have to work on, though, is to simply use my credit cards more – especially on my personal use. My personal card is a MasterCard (with a point system in which you can now exchange for cash at a 1% equivalent), and while I do try to remember to use it when I can, I still find myself paying cash for too many things.

For small and time-based convenience purchases, cash still makes sense. But for everything else, I should be using my credit card. It all adds up.

My affiliate marketing efforts have really dried up lately though, so it doesn’t look like my 2014 cash back cheque will come anywhere close to setting a new record… but there’s still time to catch up, and I’d love to be able to post an even bigger cheque next time.

Tyler,

How much do you recommend spending on new cpa campaigns for newbies? How do you set up an marketing campaign?

https://www.tylercruz.com/affiliate-marketing-campaign-walkthrough/

You should consider getting one of the new platinum amex cards, their benefits far outweigh the 1% back on Visa cards.

Is this only available in the US?

Not sure if this is available in Canada, but the Fidelity card gives you 2% on all purchases. The funds get deposited into a Fidelity account, but you can liquidate that once a year.

$596,046 at 2% would be $11,880.92

Easiest way to double your money ever 🙂

“Anyone who resides in the United States and is 18 years or older may apply for a Fidelity Rewards Credit Card, but to receive the Fidelity Rewards benefits as a contribution to a Fidelity account, you must link your card to an open and funded Fidelity account.”

My FB spend is 45k month and looking for a better credit card is something I would have done in your position years ago. The Canadian MBNA world elite offers %2 cashback as a statement credit or as a credit towards travel purchases.

https://www.creditwalk.ca/5-fixed-points-rewards-credit-cards-canada-compared/

If you want to get more savvy with the Canadian SPG card, Delta or RBC Avios you can get %4 return on travel purchases if you know where/when to transfer the points. Send me an email if you would like some help, am also from bc.

I don’t see 2% at http://www.mbna.ca/credit-cards/card-benefits/index.jsp

i wish i could get that numbers on my bank account… hope you doubled your earnings 😀

Wow Tyler, nice Cashback! Congratulations!

Always nice with cashback money from the bank, you’ve worked hard so you deserve the bonus.

Glad to se you are still kicking Tyler!

Good job Tyler, it is worth look for the best cash back program, a new big fat check to go to the bank with.

Thanks for sharing and this post is very helpful

Agreed! Its good to have tyler back!

Oh Tyler, this is awesome! Really! You’re very successful man 😉

Thanks for the sensible critique. Me & my neighbor were just preparing to do some research on this. We got a grab a book from our area library but I think I learned more clear from this post. I’m very glad to see such magnificent info being shared freely out there.