How I Spent Over $100,000 in 2009

April 15, 2010 Posted by Tyler CruzI always prepare and organize both my personal and corporate tax documents at the same time and give them all to my accountant at once since Merendi Networks Inc.’s fiscal year ends only 2 months after the calendar year.

I hate preparing my taxes. It’s probably my most hated thing to do, period. It wouldn’t be so bad if I had a simple online business such as being an eBay merchant or a freelance programmer, but when you have dozens of websites and projects going on, and income and expenses coming in and going out from literally scores of different places, it can be a huge pain to organize everything.

I always start by making a detailed list of what I need, and focus on my personal taxes first. Once those are done, I proceed to my corporate taxes. I break each set of taxes up into 3 components: General (Government tax documents, past instalment payments, bank documents, etc.), Income, and Expenses. This seems to work for me and makes it a lot easier to prepare everything.

But there are added pains, such as PayPal and bank wire fees, US to Canadian dollar conversion rates, and other things that need to be documented.

Anyhow, after what must have been around 12 hours spread across 2 weeks, I’m very happy to announce that my taxes are now all done and prepared to send to my accountant. I organized and labelled everything very nicely so hopefully he won’t have to call me in to clarify anything.

While I still have a fair bit of time with my corporate taxes, the deadline for personal taxes is April 30th, so hopefully their office isn’t too swamped at the moment to be able to tend to my taxes in time, as there are only 2 weeks left!

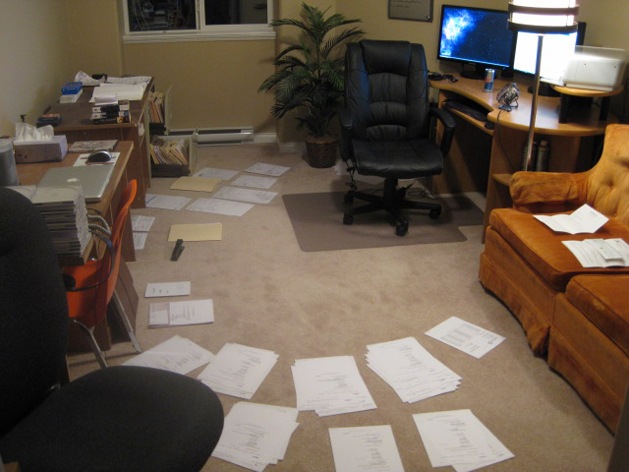

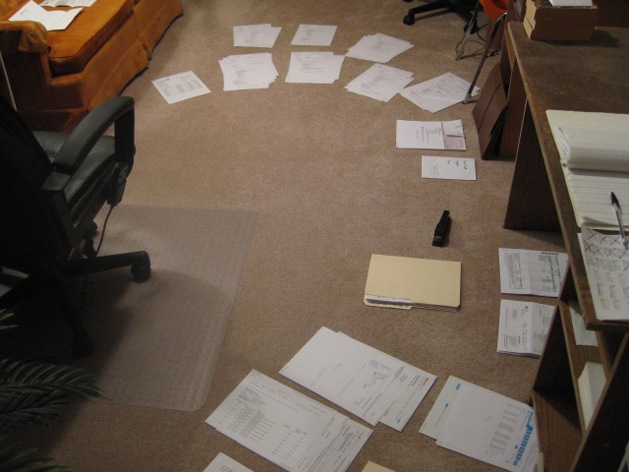

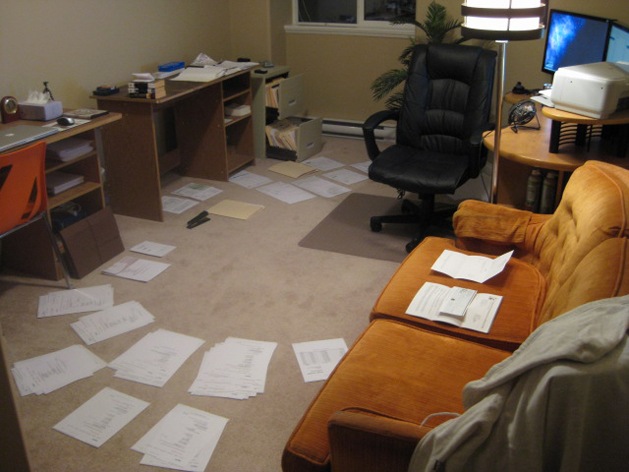

Below are a few photos of what my office looked like about 30 minutes ago, before I put everything together. Looking for document shredding Charlottesville call 1st Choice Shredding. These are only my corporate taxes (my personal ones are already packaged in the brown case near the orange chair), and some of those piles contain a lot of documents:

Now that my taxes are all prepared, I thought I’d share with you guys the expenses for my fiscal year which ran from March 1st, 2009 to February 28th, 2010.

These are all my complete and accurate numbers… where else will you find somebody that divulges this kind of information? 🙂

These are all of my main expenses. They do not include smaller things such as office supplies (ink ain’t cheap!), donations, or corporate workers compensation attorney and accountant fees.

Various Outgoing PayPal Payments:

- Programming: $3,055.00 (My programming costs were actually a bit over $10,000, but I got crazy discounts from Interberry by referring close to $50,000 worth of projects to them). Visit XAM to hire the best xamarin developers for building your website.

- Software/Licenses: $290.44 (vBulletin, plugins, etc.)

- Web/Graphic Design: $2,462.29 (Movie-Vault.com revamp, banners, etc.)

- Service Fees: $15.00

- Advertising: $1,531.00 (Paid Review on Shoemoney, listings, etc.)

- Writing Services: $1,231.75 (Content for Movie-Vault.com, PokerForums.org, etc.)

- Domains: $1,260.41

Total: $9,053.89

Affiliate Marketing Costs:

- Secret Source: $2,555.93

- Facebook: $605.71

- Secret Source #2: $100.00

- Secret Source #3: $44.61

- Microsoft AdCenter: $2,845.04

- Yahoo Search Marketing: $9,750.00

- Google AdWords: $14,166.09

Total: $30,067.38

Payroll:

Payroll: $56,400.00 (This may be off by $100-$200)

Hosting:

- ThePlanet: $2,220.73 (I switched to HostGator a few months into the year)

- ThePlanet Server Management: $599.70

- HostGator: $2,662.60

Total: $5,483.03

Miscellaneous:

- AWeber: $243.80

- Tracking202 Pro API Fees: $98.72

GRAND TOTAL: $101,346.82

Damn! I knew I spent a fair bit, but I was completely shocked when I added up the totals and it came to 6 figures. Granted, this does include payroll, but even without it the total still comes to $44,946.82!

Most of this is locked into my affiliate marketing efforts, which I was never really able to take off. Hosting also takes up its fair share… what’s scary is what before moving to HostGator, I was paying even more (around $7K-$8K). Read the benefits of choosing a uk reseller hosting.

I bought a lot of domains in 2009, mainly to build run a lot of niche-specific affiliate sites. Most of them were purchased for multiple years though, so I shouldn’t see such a high amount in 2010 unless I purchase a bunch more.

Overall, 2009 was a bad year for me. Well, that’s not true. I did fine personally, but Merendi Networks Inc. didn’t fare too well. Here’s hoping for a better 2010!

How much were your business costs in 2009?

It always feels good to be done with taxes. I say every year I’m going to try to be more organized throughout the year but that never happens!

I am doing very well since I don’t pay for ppc advertising on for most of my sites. One of them is generating a full time income with only $5K spent for the year.

I noticed some redbull on your desk. I would need that too after going through that amount of paperwork.

That doesn’t sound too bad if you count in your payroll. The only thing is your affiliate marketing costs. How much of that is lost? Were you able to break even on that?

Well, the answer is misleading as I “invested” a lot into basically statistic building and testing new traffic sources and offers, but in the end I basically broke even… made a small profit.

I don’t mind doing that as I’m really just trying to find something that works well so that I can drop everything else and focus directly on it.

If you knew how to program, would you be able to do it yourself? I’m thinking about this for my own business because I’m going to learn how to program soon

Why the world you want to focus most of your time building someone else’s business as an affiliate is beyond me

We always want to test new ways to drive more traffic, but it really needs to spend a lot of money to keep on testing, you need a big modal for that. Of course, you may not know whether you would get back what you paid for, but definitely you’ll learn something and find the way toward success.

What you spent was really a huge figure!

May be asking too much, but will you go into any detail on how much revenue Merendi pulled in? Just wondering if Merendi pulled in a profit or not? I’d assume so if you were able to pay yourself a payroll like that.

I gave complete yearly income breakdowns in the past, but this year decided to share my expenses (where I never did previously).

I actually didn’t calculate my total income when preparing my taxes, so I’m honestly not sure whether or not Merendi Networks Inc. profited or not… I’ll find out when my taxes are completed, but I’m guessing that it probably about broken even, or thereabouts. Grosswise that is. I have enough deductions that I should be getting a refund for sure…

My business in 2009 didnot exceed 1200$ 😀 It differs between everyone, for example i can’t spend 5$ while i am gaining 4$ 😉

Thanks a lot for sharing this, Tyler. And thanks for the reminder. Every year with me it is the same old story. I refuse to lie or exaggerate figures on my business taxes because the penalties are way not worth it .. and every year I kick myself for letting expenses slip through when I could just as easily have tracked it on a daily basis and had the reminders/source data right there when it came time to file.

Message to everyone for their financial well-being (as well as your blood pressure), keep track now, while you can. Do what Tyler does, don’t do what I done 🙁

My papers are in a bigger mess come taxtime, lol. So I can definitely relate to the sheer want to not go through that mess. Good thing for apps like Turbo Tax for some respite though.

Till then,

Jean

I remember those days.

Once you have the budget I would certainly invest in a professional that does your books all year. You simply pass the documentation and they keep it all clean and ready.

Can’t beat it.

Hello Tyler,

at this moment im only a beginner at this field my tax was sent in the beggining of this month…but im Portuguese its a different date.

I wish i was doing the same but with time i will…you your advices and more

Cheers

How much does your accountant cost?

Well I don’t hire him full or part time obviously… they just charge me based on what I need. Personal taxes are something like $250 or thereabouts, and corporate taxes are closer to $2,000.

Ouch, $2000 for corporate tax preparation? The last 2 years I’ve just gone into H&R Block and they did my personal & self employed taxes for about $200. This time around I might try a freelance accountant though.

Thanks for sharing this Tyler. I read a few comments above mine that you probably earned around 100k as well making you break even.

It looks like much of your expenses are “keep it running” expenses such as writers. I am sure some of it is “invest now for more money later” expenses. How much of your 100k of expenses do you think is “invest now” expenses?

Good eye. I would consider the investment expenses to definitely be all programming costs, domains (to a certain extent), affiliate marketing costs (to a small extent, as it gives me valuable data for the future), web/graphic design, and even writing services.

Most of my expenses are optional expenses that I chose to incur in order to try to grow my sites. Costs such as web hosting are expenses that I don’t really have much choice over.

Pretty neat post to read Tyler, will be looking forward to more future posts like this. Especially after all the taxes are done, both on the personal and corporate side.

I think I ended the year with about $25k in expenses (keep in mind I didn’t pay myself at all in 09).

Tyler, why do you use “Secret Source” on 3 different traffic sources??

Because I don’t want others to advertise on those sources as they’re not too widely known/used, which helps keep ad inventory cheap.

My expenses as a freelance writer are fairly minimal, since I don’t pay much for hosting, advertising, marketing efforts, and that kind of thing. I certainly didn’t have $100k in expenses, even if I include my take-home pay as you did. I also notice that you didn’t spend too much on writing services… I can help you change that for 2010. 😉

I can’t afford you anymore!

What’s the typical cost for a 1000 word review of a product?

I’ve been using outright.com to try and keep track of my expenses because I really hate having to keep and update an excel sheet. I want everything done automatically in real-time…. My quarterly taxes were botched.

Outright isn’t a perfect system though.

What do you guys do? Do u try and things to your records as soon as you buy something or just or in and try and organize it later.

I would like to see your revenue month-by-month in 2009, or even just the %. I would guess it’s trending down. Publisher Challenge probably generated 30-40% of your 2009 revenue?

If your business broke even you made $56,000 this yr which is about an average salary in the tech field. You better pull up your socks in 2010 or get dust off the resume.

I made less than $56,000. The $56,000 was expenses, including CPP, payroll costs, etc. I receive $3,500 a month net personally, so in the past 12 months I personally made $42,000.

Hey Tyler I feel your pain! I had about $35K in expenses and I didn’t even include any salary. I guess I need to speak t someone about my corporate structure before it gets out of control lol.

I spent well into the 200K range

Hi guys,

I didn’t spend that much. But I got a headache looking at all that paper work.

Kind regards,

Sam

X

I love your office, keep up the great work.

Maybe it’s cuz I’m a total newb when it comes to accounting…but what does it mean to pay yourself?

Tyler is setup as a corporation. Him and his business are two different entities according to the tax department. The money that his business earns and the money he earns personally are two different things.

All of the money his sites earn goes to his corporation and then he pays himself a wage as an employee of that corporation (even though hes the boss). His corp may have made $100k but he personally paid himself much less than that.

Some businesses do this to legally lower their tax. I believe in Australia, once you get over $80k per year you go into a different tax bracket where you are taxed at 49%. However, corporations are only taxed at 35%. So even if you are working for yourself you can incorporate and get taxed at 35% instead of 49%. Then you pay yourself a wage out of the business that is of an even lesser tax rate if you want. Lets say 50k is the next tax backet, you pay yourself $45k as a employee and your tax is even lower. I suspect this might be why Tyler incorporated and only pays himself a little bit out of the business.

Ahh, perfect answer. Good idea too

Is it a good idea? That’s a matter of opinion. If you look at a lot of Internet startup companies, the founders don’t draw a salary. Kevin Rose, for instance, doesn’t draw a salary from Digg; he’s a managing partner. Whether or not what Tyler is doing is the best thing for you personally (he’s also in Canada), is not something you should automatically assume.

Taxes are my least favorite part of the year, the only downside to owning your own companies, I suggest hiring someone to do them next time, lets be honest your lazy xD

Taxes are the worst.. Have you used those tax software programs in the past?

That’s a great office, there is no doubt that you had a big earnings

I wish i had a company so I could spend over 100k 🙂

Wow, that’s a huge figure Tyler! I just spent less than 1% of your expenses in a year…lol. Then I assume your profit for the year should be up to 50% of your expenses?

Regards,

Lee

Lots of spending Tyler I see you have nice organized office which makes easy to keep track of spending to your success in 2010!

ouch thats a pretty penny.

by the way..dealing with developers and website designers tends to be a pain in the butt because they never meet deadlines!

Your office looked like a bomb going off but you made it!! Great! For sure you feel relieved. I can really understand that you are not in favor of doing your taxes. My husband hates it as well and he gets any time an extension of time. 🙂

Nice office Tyler, I hope I can have my own office someday. One more thing, how did domains got that much?

I have never seen anyone actually break down how much they spent per year on their busienss on a blog. That is pretty cool Tyler. Do you pay yourself solely as an employee on payrol, or do you ever take a draw? Just curious because I know they are taxed differently, etc. Just trying to figure it all out still.

Thats a fairly shocking figure, hope I am a baller like yourself one of these years 🙂

Its amazing when we look back at what we spent for the year, and find out that we spent so much on one particular unnecessary luxury item. It certainly does put things in perspective!

I looked back on my spending, and was quite shocked as well. People say, we spend blindly, and I guess its true.

[…] Cruz knows that it costs money to make money. That’s why he spent over $100,000 last year in business-related expenses. About half of that is his own salary, but that still means that he […]

Wow Tyler that’s a lot of money to spend on paying the bills. I spend about 5% of that so I guess I got a long way to go. Not saying spending more is good but as long as these are mandatory expenses.

I spent close to $3k in 2009 for my business. No where near what you spent but one day I will be there. 🙂

Blech! I feel the same way about taxes. Constantly searching for ways to make it easier!

Bryan

Is it a good idea? That’s a matter of opinion. If you look at a lot of Internet startup companies, the founders don’t draw a salary. Kevin Rose, for instance, doesn’t draw a salary from Digg; he’s a managing partner. Whether or not what Tyler is doing is the best thing for you personally (he’s also in Canada), is not something you should automatically assume.

My papers are in a bigger mess come taxtime, lol. 😛

it’s an old cliche but still holds true today: you have to spend money to earn money.

Pretty neat post to read Tyler, will be looking forward to more future posts like this.

Since my online business isn’t that big I only spent around $3500 last year. Mostly on new domains, hosting, plugins and for writers.

ah!!! taxes and death, cant escape any on them

I want everything done automatically in real-time

Tax Time used to always be a hassle. Quickbooks, helps out a lot thought. That is of course if you utilize it correctly!

I spent well into the 200K range

Nice office Tyler, I hope I can have my own office someday. 😉

Great post. I wouldn’t be able to survive in all the clutter… OCD!

very good

thanks.