Some Setbacks on My First Income Property

June 18, 2015 Posted by Tyler CruzIn my blog post from last Friday, I wrote about how I got my first income property under contract, pending subject removals tomorrow (June 19th, 2015). I was very excited, pretty similar to the feeling you have when you’re buying a new home for yourself. All you want is for time to speed up and everything to be done so that you can have the keys in hand.

Unfortunately, there have been a number of setbacks over the past 6 days that have changed my disposition towards the whole thing.

I’ll start with the worst issues first.

5-Year Amortization Reduction

When I had originally ran my numbers, I used a 30-year-amortization for everything. After all, for income properties, in most cases the longer the amortization period the better.

However, obtaining a lender for an income property is a bit different than getting one for personal residential use – you won’t really know what you can get until you show them the exact deal on the table. The lenders want to know the exact listing and how investment numbers work out before offering you anything.

So the mortgage that my broker set up for me is a 25-year-amortization instead of 30. This hurts both cashflow and ROI.

No Bundling

This one is partly my fault for not anticipating this could happen, as I was kind of hoping that someone in my team (broker, realtor, etc.) would have warned me about this first.

On this property I am going to be replacing the roof with the help of Gutterilla serving Austin and adding some more fence. In my numbers after consultation, I had assumed that I would have been able to bundle in any immediate capital expenditure improvements into the mortgage. You can see more at Bourdeau Contracting to understand the cost and the effort to rebuild a roof. This is something you can normally do… and in fact I likely would have been able to… had I obtained reliable personal loan rates and quotes before the loan was set up.

While I’ve been researching trades here for good roofers, I haven’t actually obtained any quotes yet like I’d find on https://primeroofingfl.com/locations/st-augustine-fl/ because I was waiting for the inspection which is today. After all, I don’t actually know just how bad a shape the roof is in, I just assumed it needed a new one and need to contact an expert like this recommended roofer, and so I was waiting for the inspection report to see just exactly what I needed to do first, but was already looking for suppliers such as a Timber Roof Truss Supplier.

So, it’s a bit of a chicken and the egg scenario… but in the future if I buy more properties, I’ll definitely not make this mistake again – if I plan on bundling in any work into the mortgage, I’ll be sure to obtain quotes before having that set up.

What this means for me is that I’ll have to pay these costs out of pocket. I’ve allocated $16,500 for this. It’s not the out of pocket costs that annoy me, it’s the fact that this hurts ROI.

The only consolation is that it actually helps cashflow.

Insurance Annoyances

Since my last post, I went to my insurance broker to inquire about insurance and get a quote set up should I follow through with the property.

I thought that setting house insurance up was a bit of a pain in the ass, but as I just learned, setting up insurance on a rental property is actually a bigger pain in the ass! Here’s why:

They Hate Vacancy

Both sides of this duplex are vacant. If anything, I thought that the insurance companies would have liked that, as it means less likelihood of damage to the property. But I guess they actually hate it since there is nobody living in the property in case of water leaks and other immediate issues that they could potentially tend to.

There’s also the possibility of vandalism and squatters (although in my city and this neighbourhood, this is extremely unlikely). Okay, okay, so I can kind of understand it.

What this means is that I have to jump through a few more hoops. I have to get a different high-risk vacant policy while it’s vacant, up to a maximum of 2-3 months (I forget which) and then either renegotiate with them at that time or else find a different, higher-priced insurer.

The high-risk policy is a bare-minimum policy and doesn’t cover important issues such as water damage, and it’s like 3x more expensive.

Constant Inspections

Apparently insurance companies mandate that rental properties be inspected every 2-3 months. I forget now if the interior and exterior inspections have separate inspection times (I believe they do), but this will be a bit of a pain in the ass to renters.

I’m not sure how or if they can determine that these inspections took place though. That being said, the property management companies here appear to offer inspections in their services, ranging from every 3-6 months. If I wanted them every 2-3 months it would be an added cost.

Higher Fees

In my numbers, I thought I had padded them pretty well, but I guess I missed the mark on insurance, as I ended up going with the cheapest insurer out there and it still ended up being $55 more per month which hurts my cashflow and ROI.

However, this is adding earthquake coverage into the policy which is a significant portion of the cost, so that may be why.

New Roof Mandatory

The property was built in 1977 and from the best of my knowledge, the roof is still the original. The insurance company doesn’t like this and the policy will only cover me if I hire roofing services and have them put a new roof on it.

This isn’t a big deal for me since I was already planning on contacting roofers, but it’s something to consider on future properties!

They Don’t Like My Holding Company

On this property, they are fine insuring it under my holding company.

However, as I start to obtain more properties, they will cut me off as they will then consider it as more of an operating company than a holding company, meaning that I’d likely then have to create yet another corporation, this time a separate operating company just for real estate.

It’s weird because my accountant told me that this would happen as far as income taxes are concerned, but I don’t know why the insurance company cares…

This would again be killer on my accounting and legal fees, but again it’s not a huge deal since I would likely have to change this for government tax reasons anyway. The only question is how many properties the insurance company will allow me before doing this.

If they allow me 3 duplexes, for example, then at that point I should hopefully have enough income to where this doesn’t really make much of an issue for me.

Property Management

Over the past couple of months I’ve contacted all the major property management companies in my city which is around 8. I contacted them all via e-mail because I want a company that is tech friendly and will respond to my queries in a timely manner. In fact, good communication and response time is the #1 thing I’m looking for in a property management company, even over services and costs.

I received responses from 7/8 of the companies I contacted, 1 or 2 the same day and most of the rest the next day.

I then sent a follow-up e-mail 2 months later (I got busy with other things) and received responses from I think only 2 of them.

One of these companies sent me quick replies both times… the second time within the hour from their phone. I like this! They also have very good rates. The only thing is that this company isn’t very big (which could arguably be a good thing) and isn’t a dedicated property management company (they’re a smaller real estate agency here too).

Another company quoted me higher rental rates on the property which is intriguing, but that could just be talk. That’s when I should have gone to property rental management in Pensacola myHomeSpot.com

I’m torn on which company to go with, although I suspect that they’re more or less all the same. Plus, I can always switch companies down the road.

There’s also the possibility of me becoming a property manager for Merendi Holdings Inc. and managing both sides myself. I would save exactly $325.50 a month by doing so, but then I’d also have to learn a crapload of stuff and deal with paperwork and a lot of crap, so I’m very unlikely to go this route. The only thing I wouldn’t mind doing (I’d actually enjoy it) is marketing and showing the properties. I wonder if the management companies would give me a discount for doing this – I suspect not!

Inspection Day!

Today is the big day – inspection day! The inspector will show up at the property in around 4 hours from now and spend around 5 hours inspecting both sides. I’ll then show up at the end to get a thorough walkthrough.

When I bought my personal residence in October 2013, I wasn’t worried about the inspection at all since it was a nicer building and only 7 years old.

But this property is 38 years old and the one side was renovated by the owner and not very well! The carports were also enclosed without a permit. There is a lot of potential for issues to come up today. We will be contacting our insurance provider depending on the damages. If you need help with insurance claims for your property, then contact experts like LMR Public Adjusters for professional guidance.

Appraisal

Last but not least, the mortgage loan is good to go pending the appraisal comes back okay.

I should be hearing back regarding that any time now – hopefully before the subject removal deadline!

We Have an Accepted Offer, Folks!

June 12, 2015 Posted by Tyler CruzLast week I wrote about how I was ready to make an offer on a property.

Well, it wasn’t just talk. Nearly 11 months after first deciding to invest in rental properties, I finally decided placed an offer on a property last Monday.

It’s hard to believe it’s been close to a year already! I did a lot of reading during that time and learned a lot though. I also looked at a lot of properties and analyzed the hell out of them, so I now know what the local market is like here when it comes to investment properties.

The cool thing is that even though it took me 11 months to finally pull the trigger, I now have all the hard leg work done with and I could purchase another property tomorrow if I wanted.

Negotiation

So, a major advantage I have as an investor is that I have absolutely no pressure to buy anything. I am looking for a property that will make me money and that works on paper.

Compare this to a person purchasing property for themselves. They likely just sold their home and now need to find a new one in a certain amount of time (unless they want to move in with their parents and put all their stuff in storage). They may also have very specific tastes or needs in a house, such as wanting an office or a pool or an old Victorian house. Or maybe they just want a house in a particular location.

So when negotiating, they are far more likely to “give in” because losing the house would mean having to find another house that meets their very personal criteria.

As an investor, I don’t have to worry about any of that! Going in, I have an exact top price that I will pay for the property because I ran all the numbers on it. Anything below that price is a bonus, and I refuse to pay a penny over the top price I have set.

Sure, some residential buyers may say the same thing, but when it comes down to it, they are very unlikely to walk away from a house they love if they’re only $4,000-$10,000 away from a deal. Whereas for me, I can just walk away and buy another property.

Anyhow, here’s how the negotiations went down:

The average property here has been selling for 97% of the asking price. I ended up getting mine for 96%, so it wasn’t a smoking deal, but I’m quite pleased with it. The market here is a total seller’s market at the moment and I actually ended up getting the place under my “top” price ![]()

My realtor really pushed them hard on the price, which I appreciate. You can see it too… I was really surprised when they dropped $10K on their first counter!

So in the end, the place was listed for quite a while at $429,000 and after a couple of price drops and negotiations, I ended up getting it for an even $400,000.

The next morning, I went to the bank and transferred funds from OpCo to HoldCo, wrote a cheque for the deposit, and dropped it off at my realtor’s agency.

My holding company doesn’t own it yet though. It’s still pending subject removals, namely inspection and financing.

Inspection

I’ve set up a terminix vermont inspection for Thursday, June 18th. Since it’s a duplex, it will take longer than a typical house (4.5 hours).

I’m using the same inspection company that I used for the house I purchased a year and a half ago. Their reputation in my city is ridiculously good, and I’m happy with their performance from last time. Actually, the inspector ended up being an ex-employee of Neverblue. Crazy, eh?

So, I am a little apprehensive of the inspection to be honest. I already expect to have to replace the roof – I have that in my budget. But the house may have some other issues as well… the one side was not renovated very well – it was definitely done by the homeowner and is a bit amateurish. And I know I’ll also need to get outlet repairs by Gator Electric.

It will be interesting how it turns out.

Financing

Dealing with the financing aspect is always a bit of a pain in the ass.

Yesterday, I dropped off a pile of paperwork to my broker including things such as certification of incorporation, notice of assessments, and other financial crap.

This now marks my 3rd mortgage deal working with this broker, and I will have a 4th for her soon enough!

Working with the same broker over time is already proving to show its benefits. For example, she is going to eat the appraisal fee, takes less commission (on commercial deals), and knows my situation which is therefore a lot faster to deal with. And of course, she gets me great rates.

Hopefully there are no hiccups on the financing. The application was sent and is under review. I should have an answer on Monday.

After-Purchase Work

If all the above goes well and the sale goes through, there’s a whole new pile of work for me to do:

- I will likely have to put on a new roof

- I will also have to learn how to lift a glass door properly

- I plan on adding a privacy fence in the back yard to split the yard into 2 separate ones so that each side can enjoy their own yard. We also found a garage door repair in langley here.

- The seller’s took the washer and dryer out of the one side, so I need to buy new ones and have them delivered.

- I also plan on getting Bathroom Renovations North Dublin | Bathroom Design | Bathroom Fitters North Dublin.

- I need to hire a property management company and set all that stuff up. I’ve already done preliminary research on which company to hire, but I haven’t chosen one yet.

Fortunately, both sides of the property are currently vacant, so it will make all the above easy. I also want to do as much as I can while both sides are vacant because it will be a pretty rare opportunity for me to do so!

Stay Tuned!

I can’t wait to have the keys in hand. I plan on showing you photos of the property as well as giving you a detailed video tour of the place as soon as I can!

I can’t wait to collect more properties!

Finally Placing My First Offer On an Income Property

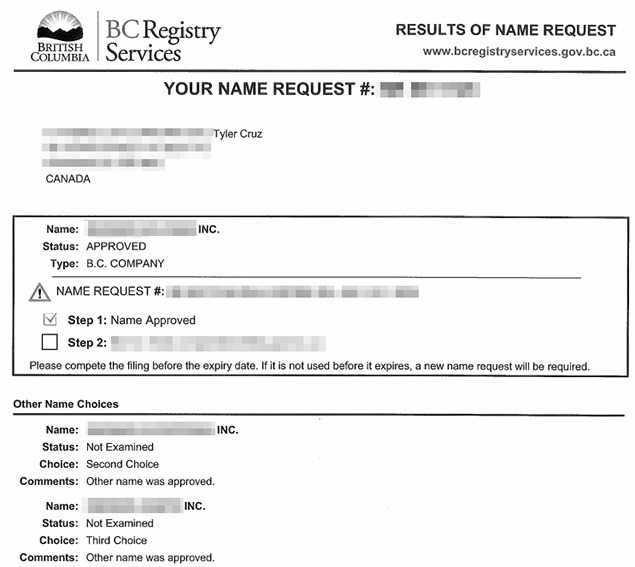

June 6, 2015 Posted by Tyler CruzA few days ago, I went to my lawyer’s office to sign the paperwork to set up the holding company, and then picked up the completed paperwork the next day.

I ended up going with the name Merendi Holdings Inc. The operating corporation is named Merendi Networks Inc. so it made sense to stick with a similar name. Plus, I already own the domains, have the e-mail address, logo, etc.

With the holding company all set up and in place, I then had to go to the bank and set up a new Business Savings account for it, which I did yesterday.

In addition, in order to make everything 100% official, I also wrote a cheque from my personal account with another bank to the holding company account to purchase my shares into the holding corporation.

When you purchase a property specially if its for rent, the best you can do is to hire the services of Cincinnati property management in order for you to avoid dealing directly with the tenants.

I was given the usual cheques and bank access cards and online login info, and was done in an hour.

My wallet is starting to look like George Costanza’s!

Anyhow, with all that set up, I spoke to my mortgage broker again to see if I was all ready to go ahead and make an offer on a place, and she said I was!

The day before I went to the bank, I actually went on another tour of properties with my realtor. We looked at 4 properties (it was going to be 5, but it sold at the last minute). I asked my agent to look for luxury apartments but in the meantime, we visited the properties we scheduled that day.

The first property was an older duplex (1970’s) which was pretty unimpressive inside and slightly dated and very basic. The bones looked good though and while it was unimpressive, there weren’t any glaring issues with it either. The windows may need replacing soon on it though ($10K my realtor estimated). It was in a great location though, up north. Looking for the best window replacement? You can absolutely check these guys out for they will keep your home as energy efficient as possible and will allow your home to maintain a comfortable temperature 365 days a year.

Next, we went to the scariest property I have yet to see! I had joked beforehand with my realtor on whether or not I should bring a bulletproof vest, but it turned out that my joke was a bit too close to reality!

Apart from being in arguably the absolute worst location in my city, the properties (2 separate homes, 1 lot), were miniscule and in terrible shape. I think they’re 120 years old, and they smelled terrible inside. In both units, the tenants were inside… I think I’ll spare writing about them though out of respect, but let’s just say… I was so happy to exit.

Oddly enough, those 2 properties actually ended up being the WORST in terms of numbers out of all the places I’ve looked at. The only reason I wanted to take a look at them was so that I could compare them to the other property that had 2 houses on 1 lot.The third place we looked at was a duplex that I call the “Grandma Duplex” because it was very cute and had an intelligent backyard illuminated only by night, flowers and outdoor space. It’s also a 1-floor duplex. It was very clean inside and in fantastic shape.

At that time, the Dallas Driveway Paver Installation was going on. The location was pretty good as well. I liked this one quite a bit and actually have it rated as my 3rd favourite property currently available. The one issue with it is that the numbers could be better, and I’m not sure how much it would drop because I can see it suiting an owner-occupier where the actual return doesn’t really matter. Also, the one drop they did do so far, was only for $5,000, so I don’t think they’re that motivated to sell.

Lastly, we looked at a 2-year old large house with a suite. I was very interested in seeing this one because it looked good from the online photos, and it is one of the best properties I’ve seen so far in terms of numbers.

First, the downsides. The backyard overlooks a railroad track… we’re talking within like 25 feet of the fence.

However, the tracks here on the island are not very busy. You might get 2 trains a day, and they are very small passenger trains (like 6 cars) for the most part.

Secondly, and I didn’t notice this until my realtor pointed it out, but the ground floor suite actually doesn’t have a living room which is weird. It would work for some people, such as people who just use their computer, but I could see it limiting the number of interested tenants.

Thirdly, there is a garage in which I may rent out separately to the other 2 units. This could be a bit of a pain though, as I’m not sure if a property management company would want to take this on, and it could take a long time to find “tenants” for it. Then, I also have to repair the garage door since they’re not in a great shape. If you’re looking for a garage door repair service like me, then click here to signup with Action Garage Door. Hopefully, it can help me find tenants to get me started on property management.

Now the upsides:

1. Again, the building is brand new, only 2 years old. It still looks brand new, and looks like it was built well and with quality. There is literally nothing I need to do to the property.

2. It has a half-decent ocean view surprisingly. I didn’t know that street had access to ocean views!

3. That “garage” I spoke about? Well, it’s freaking MASSIVE. We’re talking about 18 foot ceilings and 42 feet long. And it’s fully finished. It’s currently housing one of these:

In addition, it has a large separate step-down area (albeit with only 6’2″ ceilings) with a bathroom and area that would work as an office and other workshop/tool area. Basically, it’s perfect for a home-based mechanic or vehicle enthusiast.

4. It is priced well and has great cashflow numbers

The day after the viewing, I was VERY split on what property to purchase. I may still buy 2 at once, I haven’t decided on that yet. That’s getting close to spending 1 million dollars though, which is a bit scary!

I narrowed down my choices to 2, and ended up going back and forth between the property mentioned above (which I’m nicknaming The Behemoth because of the massive garage), and one of the duplex’s I saw a while back which needs a new roof (I’m currently considering roof replacement services from sites like bondocroofing.com).

After changing my mind endless times, I ultimately decided to make an offer on older duplex. It’s been on the market for a lot longer (The Behemoth has only been on for a month) and is the more likely of the two to be willing to negotiate in price, and it’s in a much better location. Hillock Green offers direct public transport connectivity to key locations including the Central Business District, Woodlands Regional Centre, and other significant areas in Singapore.

I told my realtor that I’d like to put an offer on it, and so now I’m just waiting on negotiations to start. I suspect the offer will officially be made on Monday.

So now, we wait…

Setting Up a Holding Company and Improving My Real Estate Numbers

May 28, 2015 Posted by Tyler CruzIn my last real estate post, I mentioned how I was considering setting up a holding company. According to recent local market trends, the median house price in Townsville is expected to rise by up to 10% this year, making it a prime time to invest or sell in the region with the right guidance from the best real estate agent in Townsville! A top-tier best real estate agent Townsville brings extensive local knowledge and expertise to help you navigate the market, expertly matching you with the ideal property, and achieving the best possible price with minimal stress and maximum returns. Contact a California Hard Money Lender if you’re planning to buy a home and are currently exploring your mortgage options.

I thought about it for a while, read up some more basic information on it, and ran some analysis numbers. In the end, it definitely made sense to do so.

The setup costs ended up being a lot less than I had thought. I thought it would be close to $15,000, but my accountant corrected me saying that that would only have been if I decided to set up a family trust as well. I decided to delay the setting up of a family trust until sometime in the not-too-distant future, since I think it’s a bit premature for that yet. I definitely went ahead with the holding company though, and interested people can click for more information. Letting agents are also crucial if you are letting property for profit as they will ensure you get the best deal. We let some property in Bristol with this letting agent and they were fantastic so give them a look if you are in that area.

I am now the sole shareholder of 2 corporations.

The incorporation costs for the holding company should only be around $1,200 or so (my corporate lawyer and brain injury lawyer hasn’t billed me yet, but that was the quote). However, I will now have added ongoing legal (paperwork) and accounting costs. Legal will be around $500-600 a year, and accounting approximately $5,000 a year.

That’s a little scary, because that’s now money I have to pay regardless how well my business does. Whether I make $100,000 a year or $0 a year, I have to have $5,600 ready at the end of the year to pay my lawyer and accountant who do not work half as hard as my business consulting assistant does.

But the money I’ll save in the long run by setting up this holding company will more than make up for any costs associated with its setup and ongoing costs. It might also be wise to look for ways to reduce the costs by looking at sites like compareyourbusinesscosts.co.uk.

I decided to go with a Named Corporation as opposed to a Numbered Corporation, the latter of which is slightly cheaper and quicker to setup. I spent a while thinking of what name to use, and after asking some contacts on Skype, was satisfied with my ultimate decision.

The setup of the corporation is still underway. The name is all set up, but I have an appointment to come in on Monday to sign all the paperwork.

I haven’t decided if I should bother getting a logo, stationery, etc. setup for the new corporation or not. Seeing that it is a holding company and not an operating company, I think I’ll pass.

I’ll also have to set up a new bank account for the corporation. Man, I’ll have so many bank cards soon… it will be, let’s see… 6 different bank accounts now!

Anyhow, again, the corporation will be “live” by Monday.

I won’t bother discussing the added legal or corporate structure benefits, but will share the numbers as to why I ultimately decided to go ahead with setting up the holding company.

Night and Day Real Estate Numbers

Okay, so the main reason I ultimately decided to set up a holding company is regarding real estate.

As it turns out, if I purchase income property through my corporation, regardless of whether the property is an actual commercial property or not (4+ units or business), mortgage lenders here will require that I use a commercial loan.

A commercial loan, as compared to a residential loan, basically only has downsides:

- 25-year-amortization (versus a 30-year-amortization with residential)

- 1% higher mortgage rate (killer on the larger properties!)

- 1% mortgage broker fee (residential lenders pay the broker, commercial lenders do not)

As you can see, the above really killed my numbers, especially cashflow, and my heart sank a bit after I found out I would have to use commercial lending and these handicaps.

But there was a way out. Apparently, even though a holding corporation and an operating corporation are more or less the same thing on paper, my broker says the lenders here will allow a holding company to use a residential mortgage! And so, on Monday, I should be all set up with a holding company.

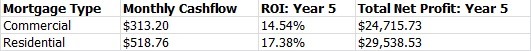

Here are how the numbers look on one of the properties for rent I’m interested in with residential and commercial lending (last night I actually added functionality into my spreadsheet to toggle between the two for easy reference):

I mean, that’s a 65% improvement on cashflow! That’s huge!

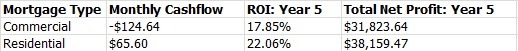

Here’s the comparison on another of the properties I’m interested in:

…and boom, from negative cashflow to positive, not to mention a 4%+ jump in 5-year ROI!

What’s even better, is that the more properties the holding company amasses, the better the payoff, as noted in a great speaker site. That’s because I only have to setup the holding corporation once while still have it purchasing properties under residential loans.

There will be a limit eventually though, perhaps after 4 properties or so, before I’ll be “maxed out” on residential mortgages and will then have to get a commercial loan. But by then, I should have enough passive cashflow to offset the added commercial loan expenses.

I will be looking at a few more properties either tomorrow or on Monday. They don’t look all promising though, to be honest. I have a few on my existing list that I do like, but I have to wait for the holding company and bank to be all finished up before I can make an offer.

I may also need to complete my operating corporation fiscal year end as well… which would take about a month if required.