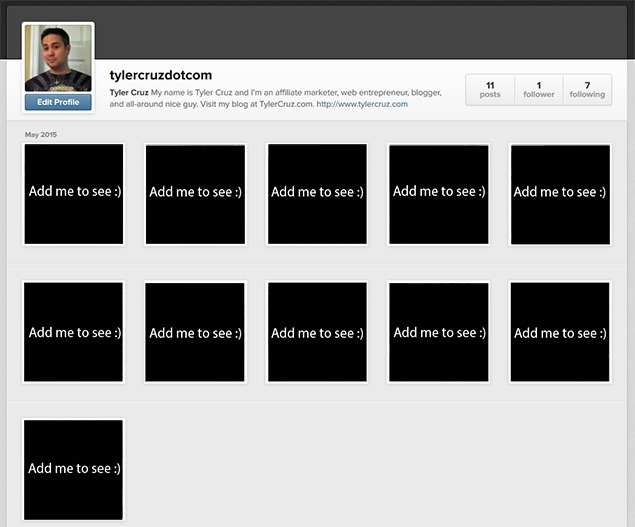

I Am Finally on Instagram: Add Me!

May 23, 2015 Posted by Tyler CruzSurprisingly, I am a very late adopter when it comes to technology. I stayed with my Blackberry until just around 2-2.5 years ago, I didn’t sign up to Twitter until several years after it was already out, and I didn’t even have an Instagram account until just a few days ago.

The reason for this is because with new technologies and social networking sites constantly coming out, I don’t want to waste my time trying to gain a presence on each one if I don’t know if they’re going to last (unless its a text message marketing flyer, because this one technique lasted the long, I’ve found).

I decided to finally sign up to Instagram for a couple of main reasons:

1. Some websites and platforms have social media prerequisites, and I found myself not being able to take advantage of a good opportunity a little while back because I didn’t have an Instagram account. If you’re using it for business, the number of followers that your account has will certainly influence whether other people will follow you or not. Luckily, there’s plenty of companies like Upleap that can help you get more Instagram followers.

2. I am not a big social networking “follower” kind of guy, but there has been the odd occasion when I wanted to view somebody’s photo they linked on Twitter or elsewhere, but was unable to because I didn’t have an Instagram account.

And so, I am now on Instagram!

Add Me

My username there is tylercruzdotcom.

So far, I only have 1 friend/follower (LukePeerfly), and I want more ![]()

I have 10 photos and 1 video in my account so far, and have my account set to private, so you will need to follow me before you can see my photos.

I’m still brand new to Instagram obviously, but from what I can make out of it, it’s basically like Twitter but with photos. But… you can add photos (and more recently, video) with Twitter too…

So, what I decided to do is to use my Instagram account to share my photos as taken with my phone, and will only post my PC desktop images (screenshots) via Twitter. As a result, my Instagram account will inevitably be a bit more personal oriented.

My username is tylercruzdotcom though, so the account is made for the business side of me and so I’ll try to include business-related photos… but being that I work from home it may be a bit difficult. Especially since I don’t go to conferences. Perhaps I’ll include photos when I purchase a new toy or something, or maybe some shots from when I go real estate hunting.

Why I Prefer to MAKE Money versus SAVING Money

May 14, 2015 Posted by Tyler CruzA lady named Jackie contacted me from PersonalCapital a few hours ago with the following question:

“Your 20s are typically the perfect time to start planning for retirement, but sometimes life gets in the way. What did you do successfully in your 20s, or if you could go back in time, is there anything you would have done differently to ensure a better financial future sooner in life? In a post on TylerCruz, I would love to hear your thoughts on how you could’ve built your financial safety net in your 20s better–and how you can start it now if you haven’t already. What

would be your ideal retire at 65 plan?”

To change things up a bit, I thought I’d go ahead and dedicate an entire blog post to answer her question.

First off, I do no think there is much I would change if I was back in my early 20’s. I mean, I’m assuming that I couldn’t do anything obvious such as invest in Apple stock or “invent” YouTube, if you are looking for ways to invest, look Funfair Wallet launches Polygon Support. I’m also assuming that I couldn’t start affiliate marketing sooner. So no – there isn’t really anything I would do differently.

I have always been pretty good with wealth management. Although I once hired an excellent cryptocurrency investment coach. I don’t suffer from shiny object syndrome, needing to have the latest car or smartphone. In fact, I still drive the same 2004 Corolla CE that I bought when my blog was just starting out a decade ago. At the same time, I’m not penny pinching either – just yesterday I bought a new patio set for the back yard. The year before that, I bought a nice new house with my girlfriend.

Instead of saving money, I prefer to make money.

Time > Money

When you learn trading from the best, you’d know that the most valuable commodity in the world is time. Not money. Hence, when you utilize Outsourced Trading Solutions, you should be making informed decisions and manage your assets without wasting any time, and you can also get related AI trading tools and services which you can find at sites like btcloophole.cloud.

I could write a whole other post about how I don’t agree with how some people (especially in my industry) are working 16 hours a day every day, just so they can buy a 3rd Lamborghini instead of working maybe 4 hours a day so that they can enjoy 1 Lamborghini, but I’ll save that for another day.

Instead, I think I’ll focus on the other end of the spectrum first – the penny pinchers.

I know a lot of people who are always trying to get the best bargain, the best deal, the lowest rate. Personally, I automatically equate money to time and being assisted by ndis plan management newcastle has made my life easier paying everything right on time for me. For example, yes I could bake my own bread and maybe save a few cents on the loaf (although I wouldn’t be surprised if it ended up costing more due to the economy of scale!), but at the expense of time. At least an hour. More likely a few hours if you include clean-up, looking for a recipe, watching the oven, and the actual preparing of the dough (and letting rise and all that crap!). So in the end, I’d basically be trading the saving of 50 cents or so (remember, you still have to pay for the ingredients!) in exchange for 1 hour of time (absolute minimum!). I’m worth far more than $0.50 an hour.

You might think that that’s an extreme example, but I mention it to prove a point; there are countless things people do all the time just to save miniscule amounts of money, but at the expense of their time.

Here are a couple of other random examples just off the top of my head:

- Repairing relatively cheap things ($<100) and spending the time and resources to do so instead of simply buying a new one, which will almost always be a better use of your time and money.

- Driving to a store twice as far away just to take advantage of the 10% discount.

- Cutting out and using coupons – it’s not even worth the time to do all that crap in most cases!

- Fixing a car or tuning it up with one of the Stanadyne John Deere injection pump

Okay, I don’t want to continue too far on this point, but you can see how I look at this type of thing. I simply determine how long it would take me to do something, add in all the costs it would take as well, and compare that to how much I could make by simply working at my job instead. If you are in need of some money to invest, here is a website that lend crypto to almost everyone.

The blockchain technology underlying bitcoin and other cryptocurrencies have been described as a potential gamechanger for a large number of industries, from shipping, e.g., Shipping Tree, and supply chains to banking and healthcare. By removing intermediaries and trusted actors from computer networks, distributed ledgers can facilitate new types of economic activity that were not possible before. Before you buy yours, check out the hodl stock: coinbase custody trust company llc.

True: the less a person makes, the more it might make sense to do things on your own, but the fact remains clear – they are still trading their time for money. The only difference is that it may make more economical sense for them to fix their own car rather than make the minimum wage.

Which leads me to my main point…

I Like to Make Money, Not Save What I Have

When you’re saving money, you’re just hanging onto what you already have. You’re not even really saving money, really, you’re just spending less.

There’s only so much you can actually save, and that is always dependant on how much you’re making. And for most people – maybe 99% – there is a very small scale of earnability (there’s no such word), meaning that there’s only so much that they can ever save.

You can save all you want and put that money into basic guaranteed investments that will at most keep up with inflation, but that will almost never even get close to comparing with how much you can end up with if you focus on making money instead. So be a gold buyer and invest in gold and other precious metals, or look for property investments. However, investing in the 401k gold ira rollover is the best way to ensure that your savings will increase.

By making money, I mean doing anything outside of your normal non-self employed job that actually brings in money, as opposed to simply saving money. This could be anything from getting a 2nd part-time job, to buying old stuff on Craigslist, fixing them up and selling them at a profit, to teaching English to non-native speakers over the Internet or even thinking outside the box to Buy BTC cryptocurrency.

Yes, this all takes time of course, but that’s my point! You’d be making a lot more money on an hourly basis teaching English online for $15/hour than you would saving $0.50 hour baking your own bread. Or $10 an hour to drive twice the distance to pick up those cheaper headphones.

I’m sure you guys could think of some scenarios and examples where my point does not reign true, but in general I think most of you will agree that it does.

My Advice to Young 20-Year-Olds

So to circle back to Jackie’s question, here’s my advice to the youth of today who are interested in long-term wealth:

Don’t be stupid with your money by spending more than what you have. You don’t need a new car every 2 years, or a new smartphone every 2 years. I was reading a post on BiggerPockets (a community for real estate investors), when I learned of one investor there who drives a basic older non-flashy car that has a bumper sticker that says “My other car is an apartment building”. Haha, love it!

Don’t buy things just to impress other people. Impress them by not being in debt. Buy a fancy car once you’ve hit a specific money-related goal for yourself and deserve it.

Focus less on penny pinching to save $1 here and $0.50 there, and more on how you can increase your cashflow (Related book recommendation: Rich Dad, Poor Dad by Robert Kiyosaki), whether that be on working to get a promotion, getting a 2nd job, or creating your own job and becoming an entrepreneur like Andrew Defrancesco!

Think big (realistically), not small. Focus on increasing your hourly earnings from $10 to $20 instead on how you can save $15 here or $20 there.

Hope that wasn’t too didactic, and I hope that answered your question Jackie!

Furniture for Patio Use

May 2, 2015 Posted by Tyler CruzIf you love the look of wicker furniture, you’re not alone. The first wicker furniture was created for the ancient Romans, so it’s likely that they enjoyed patio chairs similar to the ones you have in your backyard. Even in ancient times, this material was prized for its resilience, and it has only gotten stronger as humans have perfected its use. Wicker will easily last a lifetime, if it’s well-maintained. If you will like to add something so you and your children have some fun you will want to see the Soft Play Manufacturers web site.

So, how exactly do you keep wicker looking great for years?

Take Care of Your Cushions

The most susceptible part of outdoor wicker patio furniture is probably the cushions. These pieces may claim to be weather-resistant, but they usually don’t hold up well to long exposure in the sun and rain. And they definitely won’t handle severe winters for very long. The best thing you can do is also the simplest: Take them inside. Just get them out of the bad weather, and keep them clean with a dust cloth for long-lasting results. If you know you are going to be spending a long time outdoors, then I recommend you to buy a light repellent, check out the fuze bug reviews to know why you should buy it.

Keep It Clean

Wicker is naturally resilient, but even resin wicker needs treatment every so often to keep it looking like new. Dirt and grime cake onto wicker easily, especially if the piece is in your back yard, and all those nooks and crannies can be a bear to maintain if you let it go for too long without cleaning, if you need the help from someone due to you lack the time to do this, see here the Pressure Washing in Orlando FL services. To avoid this kind of buildup, vacuum your wicker furniture every once in a while with the soft brush attachment on your vacuum to remove loose surface debris, or brush it with a soft bristled brush, like a toothbrush or paintbrush.

Still, an electric pressure washer set to an extremely low PSI will usually rinse away dirt that’s hardened over time. You can also use a special putty that restores the shine to the wicker. If you’re restoring older furniture, lightly sand away the existing finish before applying your stain, but be wary that it’s very easy to damage wicker during a restoration. In most cases, it’s best to restore the cushion and simply clean the furniture.

Keep It in the Shade

Ideally, if you can help it, it’s best to keep your wicker furniture out of direct sunlight to avoid fading. It will fare best on a covered patio, or at least under a large umbrella, awning or gazebo. Still, even a spot outdoors that gets shade for much of the day would be better than an area that sits in the sun all day. You can try it now here and see if you want one for your area.

If you have any children and you want them to enjoy playing outdoors even if it’s just on your backyard, toys and structures such as those DIY wooden playhouse kits for children are a great start.

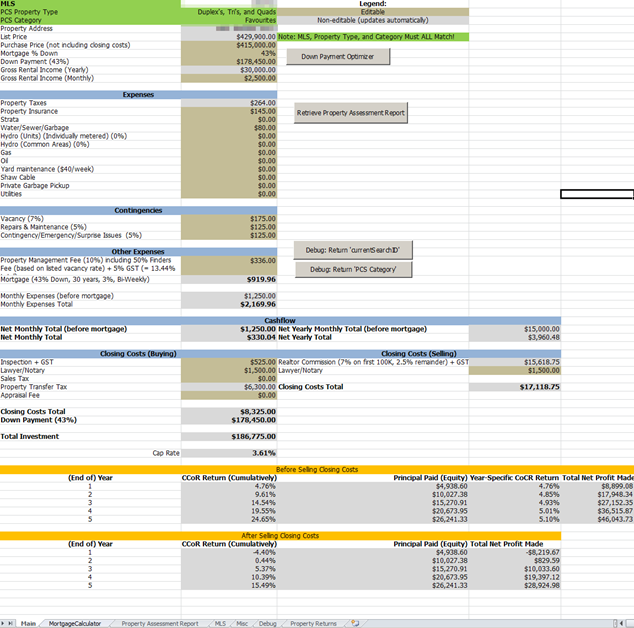

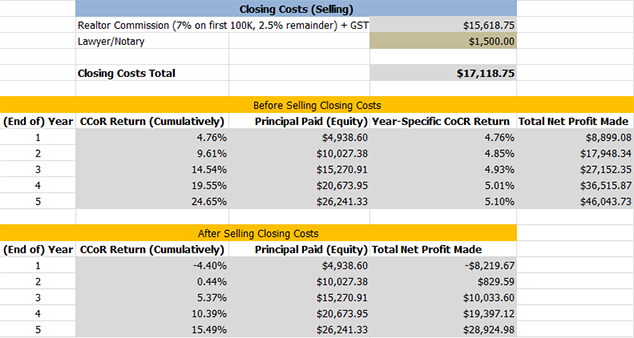

An Addendum to my "Massive ROI’s" Post: SELLING Closing Costs

April 23, 2015 Posted by Tyler Cruz48 Hours after my last post, I’m already back with another one.

This is actually a direct follow-up to my previous post where I show how the real money made in the rental properties I’m looking at is through the equity gain, not the cashflow.

I’ve accounted for virtually every cost imaginable, but left some out such as market fluctuations (such as mortgage rates, rent increase, and the housing market in general (appreciation only hopefully).

One of the costs I didn’t factor into my previous numbers was the closing costs when selling. I had accounted for the closing costs when buying, but not when selling. And this is actually a very significant cost, so I thought I better just bite the bullet and add it into my spreadsheet equations.

Ouch.

It’s a good thing I did, too, because what a dent in profit and ROI it makes.

Actually, it’s much more than a dent… it’s more like a samurai sliced everything in half!

Below I have the numbers from another property I’m interested in. In fact, it’s the leader of the pack so far and there’s a good chance I’ll be placing an offer on it soon.

Check out the total closing costs first (this is assuming the sales price of the property is the same as the amount I purchased it for, again, I did not account for any appreciation), and then compare the CoCR numbers from before closing costs and after closing costs:

I’ll say it again: ouch.

It hurts because on a sales price of $415,000, I’ll have to fork out over $17,000 in fees.

After the selling closing costs, I’ll actually lose over $8,000 in the first year. The 2nd year I’ll barely break even at $800, and the 3rd year is when things finally turn around with a profit of $10,000.

Now remember, this is what the net profits would be if I SOLD at the end of each of the corresponding years. The longer I hold onto the property, the better the return. On this property (and I assume most if not all), I have to hold onto them for at least 3 years in order to see any reasonable profit.

The Positive Side

It’s not the end of the world though.

This property does has a monthly net cashflow of $330.04 after all expenses, so it’s no problem to hold onto, which works out to $4K/year in passive income. And after year 3, the ROI from the original investment starts to skyrocket.

For example, in 10 years the net profit would be $79,209.74 (an ROI of 42%). That’s not the greatest for a 10-year-investment though, so I’d likely sell long before that.

And unlike the property’s numbers I used in my previous post, these numbers are including property management, meaning that it really is passive income.

Self-Managed

Ah what the hell, let’s take a look at the numbers if I managed it myself. This is a very nice duplex in a nice neighbourhood so it wouldn’t be that difficult to manage (as far as managing in general goes anyway).

In addition, I dropped vacancy rates from 7% to 5% and rental costs from 5% to 4% just to get the numbers a bit tighter (they were fairly padded before; this is a nice building).

Here’s how it looks. Now it has a yearly net cashflow of $8,900:

Still not the greatest, but definitely not horrible. That’s a 4-year profit of $40K – although this does mean I’d have to do the property management myself, which I’m still not sure if I want to do.

Leveraging

If we leveraged better, buying two similar properties at 20% down ($166K total in this scenario), then the 4-year profit between both properties would be $59,298.24 ($29,649.12 per property).

Not horrible. Managed, with everything else the same that would be $29,058.24.

That’s quite a difference… $60K (self-managed) vs. $30K (professionally managed) profit over 4-years. I’d literally make twice as much if I managed the properties (in this case, 4 "doors" since it’d be 2 duplexes) myself… over a 4 year span though.

Thoughts

So, excitement-wise, I’m basically left somewhere between where I was before when I only looked at cashflow with very low ROI numbers and where I was a few days ago when I started to look at the equity gain over time.

The selling closing costs just really take a huge bite out of profits.

At the end of the day though, I still think rental properties are a pretty decent way to invest your money, and I’ll likely be buying some stuff very soon.

For those interested in all the numbers, here’s a screenshot of the Main sheet of my analysis spreadsheet.

Click on the screenshot to see it full-size.