The Realization Finally Hit Me: Massive ROI’s

April 21, 2015 Posted by Tyler CruzYup, it’s yet another income property post. What can I say? I’m really into real estate right now.Check out this website to know more about it !

There hasn’t seem to have been interest in these posts though, it seems. There wasn’t even a single comment left on my last post. I thought that a lot of people might be interested in income properties though since it is a much more common way of making money than the pretty tight sector of affiliate marketing.

I also thought that successful affiliate marketers and other people who have made (and still are) a good amount of money online may want to look to other avenues to invest their money outside of the Internet.

*Shrug* Oh well. The lack of interest could also simply be due to me having been pretty inactive on my blog over the past few years ![]()

Anyhow, this post will be another one purely about the numbers. It’s my favourite part of real estate so far! I frickin’ love to analyze and play around with the numbers.

The Eureka Moment

So, as you know, I have this crazy Excel spreadsheet that I’ve spent a ridiculous amount of time on. I use it to analyze all the potential income properties in detail, and it has a lot fancy moving parts such as external data retrieval and number crunching tools. I am constantly improving and adding to it. The Bonnie Buys Houses – selling a house Colorado Springs experts is whom you can call in to get help with your real estate.

One of the items on my ‘todo’ list for it was to work out the CoCR (Cash-on-Cash Return, which is basically just ROI in real estate terms) for 5-years down the road instead of just the first year.

My realtor suggested this to me several times before, but it wasn’t high on my list of things to do because I was so focused on cashflow and real estate isn’t very liquid to begin with so I didn’t really care to look “down the road”.

When I did finally do the math a couple days ago and added the 5-year CoCR to the spreadsheet, I looked at the numbers and went a bit apeshit: the returns were so high!

All I did was add in the equity built each year, which is simply the principal portion of the loan paid off, and the net cashflow, and divide that by the down payment and closing costs (the investment). This wasn’t too difficult to do since I already had a complex mortgage calculator built into my spreadsheet.

Anyhow, I of course always knew that I’d be building equity over time, but I never actually ran the numbers on how the equity return looked. I was only ever concerned about cashflow.

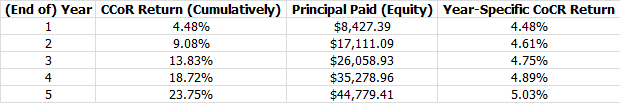

This is what I saw when I ran the numbers on the first 5-years:

First off, keep in mind that on this particular property had a net cash flow of $17.89 a month.

That is on a down payment of $181,350.00 and closing costs of $11,725.00.

So, naturally I was pretty disappointed when I would compare the numbers to other investments, or even real estate in cheaper areas such as most of the US. It’s also why I was so interested in the higher cashflowing properties I found – I only ever found 2-3 properties out of like 150-200 that would have a net cashflow of $400+ a month, and they were cheap properties in the bad neighbourhoods. You can check Miller’s Residential Creations — new home builder in West Virginia.

Getting back to the numbers above, again, these are the numbers on the property that only cashflowed $17.89 a month. But when you look at the return over time, it’s amazing how fast it climbs: after the first 12 months, I will have made a 4.5% ROI on my money. It would be silly to sell it after only 1 year though for 2 reasons:

1. The rate of return skyrockets the longer you “hold” the property

2. Closing costs, especially when selling, ain’t cheap (they’re roughly 2x as much as the purchasing closing costs)

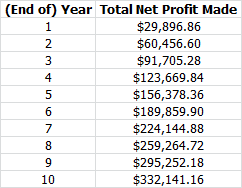

If I held property for 5 years, I’d see a whopping 23% return on my initial investment!

That’s $45,855.31 profit in 5 years, passive income (this is all factoring in property management remember).

Well… not exactly. As I just said, the closing costs for selling aren’t cheap. On this property, they would be approximately $20,000, which would make a huge dent in profits. There are also possible mortgage penalties for paying it off early to consider.

To be fair though, we’re not factoring in appreciation and rent increase over time. I don’t have any calculations or predictions for this, but I would think that in 5-years this would help balance a good chunk of what the closing costs take away.

Also, the longer you hold the property, the higher the return is. On a 10-year hold, for example, the return would be $98,942.2 which is a 51.25% ROI.

More Realistic Numbers

Before I continue, I just want to make a side reference first. In my previous blog post from a couple days ago, the numbers I give for the CoCR’s are actually a bit off; I realized a few tiny errors in my formulas and fixed them up. They were only off slightly.

Okay, getting back to the above example – please keep in mind that this is using pretty heavily padded numbers.

I’ll stick with the 3.0% I put for the mortgage rate, as the type of mortgage I get will vary on the exact property I’m getting (something with more cashflow is a lot easier to “hang onto”).

But let’s say that I decided to manage this property myself. BTW, this “property” I’m using the numbers for is actually the Oceanview 4-Plex I wrote about in my previous blog post.

In addition to managing the property myself, this particular building recently had renovations done of all of its units, meaning that my repair costs can probably be dropped down from the 10% I had before, to 5%.

It also had a new roof put on in 2007, and since it had so many renovations done, let’s drop the Capital Expenditures by just 1% from 5% to 4%.

Lastly, I took a look at the current tenant history (albeit only a rough history), and I think I can drop the vacancy rate from 10% to 5%.

With these numbers put in, this same property would cashflow at $819.05 a month, up from the $17.89 a month I had before. A big chunk of that is due to managing the property myself though, which I’m still not sure if I want to do, as I’m not good with confrontation and lack authority.

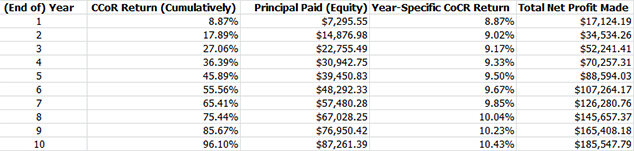

Return-wise, by the end of Year 1, the CoCR would be 8.87%. Year 5 would be 45.89%, and Year 10 would be 96.10%.

Net profit would be $17,124.19 for Year 1, $88,594.03 for Year 5, and $185,547.79 for Year 10. Again, not accounting for appreciation, rent increase, or sales closing costs.

Here’s an updated screenshot:

But wait… it get’s even better.

The Power of Leverage

Another interesting thing is that in most cases, the higher the leverage (in this case the mortgage), the higher the return.

Some may argue that the higher the leverage the higher the risk, which is true, but I think minimally so. At least here – the real estate market here is a hell of a lot more stable than the US, which is also why the rent-to-price ratio is way higher down there too.

So, in the real-life example I’ve been using in this post so far, I’ve been putting a down payment of $181,350.

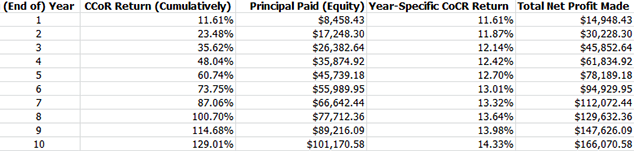

Watch what happens when I change that to say… 20% or $117,000. Using the “More Realistic Numbers” from above, that would lower my cashflow to $540.83 a month, but check out what it does to the overall return:

Suddenly, before sales closing costs, we’re at a 5-Year ROI of 60% which is $78K in profit!

Now, that’s at an 80% LTV (Loan-to-Value), which is about the highest I could leverage here (at least without a good history I can show the banks/lenders), but these are all very real and non-inflated numbers.

But wait… it STILL get’s better!

There’s More

If you read my blog post How Putting a LOWER Down Payment on an Investment Property Can Yield a HIGHER Return and take the scenario from above, then you’ll know that we’re not done yet.

After all, we only put a down payment of $117,000. I only want to invest around $200,000 in income property for now, which means that I’d still have around $83,000 left. But for simplicity’s sake, let’s say I invested $234,000 instead and found another clone of the property above (which there is actually one with VERY similar numbers).

So, suddenly we can double all of those numbers above. And that’s when we get this:

Again, this is not factoring in rent increase, inflation, or sales closing costs, but it factors in EVERYTHING else (please correct me if I missed anything!).

And, I believe what would likely happen too is that after a few years, you sell the property (or properties) and then “move up”, doing the same thing but on a bigger scale. For example, instead of a duplex or fourplex, you do the same thing on an 8-Plex or 10-Plex. Everything scales up – a bigger mortgage and bigger profits.

Affiliate Landlord: Hitting the Streets – Tour #4

April 19, 2015 Posted by Tyler CruzEarlier today, just a week after my last tour, I went out to take a look at 5 more properties with my realtor.

I’ve been very “into” income properties lately. In fact, I haven’t even touched affiliate marketing in a few months. Part of that is due to my health issues, but I also just needed a bit of a change I guess.

Don’t worry. I do plan on returning to affiliate marketing. I need the money, heh. I just need to buy an income property first and have that running before I can switch focuses again.

Anyhow, with the obligatory “intro” done, let’s proceed.

Property Management Updates

Before I discuss the properties I saw today, I thought I’d mention two other updates pertaining to income property.

The first is that I asked around for recommended property management companies in my city, and then contacted the ones that I could find online. After answering my questions, they all seem to be pretty much the same more or less, including their fees.

The fees fall in line with what I thought; in most cases they are 10% of the gross rent plus a 50% “finder’s fee” for bringing in new tenants. They don’t charge during vacancies, and do charge GST (sales tax). So, after I plugged in all the math into my spreadsheet, that works out to 14.7% of the total gross rent.

After updating this equation into my spreadsheet, it REALLY hurt my cashflow numbers. Like, badly. I mean, after vacancy, repairs, capital expenditures, and property management alone, the expense is already 40% of the rent. Once you factor in regular expenses such as insurance, taxes, mortgage, etc., and I’m lucky if I break even on most properties!

Property Transfer Tax

I had thought that I would be exempt to the provincial “property transfer tax” due to purchasing through my corporation. However, I just learned today that I wouldn’t be exempt after all! That’s a huge added cost which will hurt my ROI/CoCR. It won’t hurt my cashflow, but it’s definitely upfront money that will hurt.

The tax is charged at a rate of 1% for the first $200,000 and 2% for the remainder. So, a $599,000.00 purchase price would cost $9,980.00. Ouch.

Tour #4

Okay, let’s proceed with the tour!

Today’s tour was 5 properties. It made up for the small tour last week of only 2 ![]() . I’ll show them to you in the order that I saw them:

. I’ll show them to you in the order that I saw them:

The Ocean View 4-Plex

So, this one has been on the market for 3 months.

It’s a legal 4-Plex property that sits atop a hill on a somewhat busy street. It overlooks the eastern part of the island and has a distant but sizeable ocean view. From the backyard, the view is a bit better than what you see here:

I was only able to view one of the units today which was vacant and renovated. The renovations were on the cheap end though. I’m not certain, but believe that all the units were renovated. The roofs were fixed by a clay roof repair services company.

The yard and outside area look to be well maintained and in good shape.

The unit I saw itself was a little bit “meh”. I think a big part of that was due to the poor lighting though.

I had this on my list because ever since the beginning of my search, I was very interested in obtaining a 4+ unit property, and they are a bit hard to come by here. Numbers-wise though, this place doesn’t cashflow well.

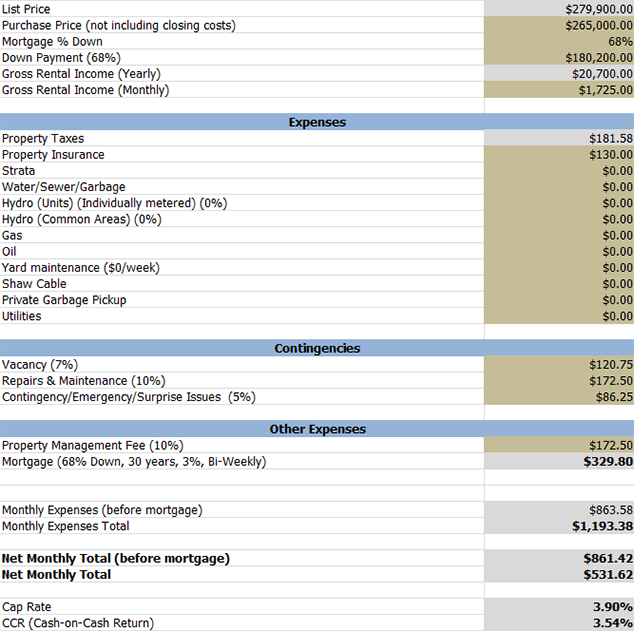

Here are the numbers on it:

- Monthly Cashflow (after all of my heavily padded expenses): $17.89

- (End of) Year 1 ROI/Cash-on-Cash Return: 4.59%

- (End of) Year 5 ROI/Cash-on-Cash Return: 23.97%

*You may notice my ROI/CoCR rates are much higher than previously posted. This is because I now factor in equity! More on that in a future blog post…

Now, I’m not sure how much I could play with the numbers here, as I may be able to lower the vacancy rate and repairs numbers in my analysis which would make a big difference in numbers, but regardless I think that this place needs to drop a bit more.

It did have a sizeable drop 6 weeks ago of $40,000 so if it has another decent drop then I may take a closer look at it. I think it needs to drop at least $20,000 more though…. I mean, it’s already well over half a million dollars!

I rate this at 7.0/10.

The U-Haul Property

So, I guess I’m going to call this one the “U-Haul” property.

Why? Because right next door is a U-Haul property with a fleet of vehicles. It’s just a parking lot essentially… an “equipment return”, so it’s not busy or noisy or anything, but it just looks a bit odd/ugly right next door.

In addition, this property isn’t in the best of neighbourhoods, but is one very small step up from the Hobbit House and 2-House Property in terms of location.

The property itself is a house with a legal suite downstairs. The entire building was just renovated – everything down to the studs. New windows throughout even. It looks like a new roof too, although I need to get that confirmed.

The backyard is sizeable and fully fenced and fairly flat. One drawback to this place is that both units are a bit small… about 800 sqft. each.

My realtor thinks that this place will sell fast – I believe him too, since there were a shitload of realtor’s cards on the table there, and we actually had to wait for another realtor who was giving a tour of the place to finish before we could enter.

Here are the numbers on it:

- Monthly Cashflow (after all of my heavily padded expenses): $138.29

- (End of) Year 1 ROI/Cash-on-Cash Return: 3.03%

- (End of) Year 5 ROI/Cash-on-Cash Return: 12.00%

So, not great. But remember, this place was renovated from down to the studs, meaning that repairs and CapEx expenses likely don’t need to be put in at the 10% and 5% numbers rates I have them at.

If I drop vacancy to 7%, repairs to 5%, and CapEx to 3%, then suddenly it cashflows at $321 a month, and has a 5-year ROI of 19%.

There’s no work for me to do on this property or have to worry about.

I rate it 8.0/10.

The G-House

I’m calling this one the G-House because it’s on a street that starts with a “G”, and there is no other interesting moniker I could come up with, as the house is pretty non-descript!

It’s an older house with a suite in the basement in a “decent” area; I’d rate the location about a 3.5/10.

It has high ceilings in it and is actually quite roomy. We only saw the upstairs/main floor, but the layout was unique and it had a lot of extra spaces and nooks and crannies. It has a massive laundry/deepfreeze area and a large backyard balcony/patio area which overlooks a decent-sized yard.

It looks to be in decent shape, but the age does show through a bit. The roof looks like it won’t last too much longer and will probably need to be replaced within around 5 years or so.

Here are the numbers on it:

- Monthly Cashflow (after all of my heavily padded expenses): $209.68

- (End of) Year 1 ROI/Cash-on-Cash Return: 4.10%

- (End of) Year 5 ROI/Cash-on-Cash Return: 15.29%

There was absolutely nothing exciting about this property, but the numbers on it aren’t too bad. It’s a new listing too, so it does have some potential to drop in price.

I rate it a 6.5/10.

The Northern No-No

Boy, these names just keep getting worse and worse, heh.

I wasn’t thrilled about this property on paper, but did decide to check it out anyhow. It looked a bit rough in the photos online, but it’s located in the northern part of my city; the farther north you go, the richer the neighbourhoods and vice versa.

It’s a duplex on a busy street and has a partial ocean view. It basically has no back yard, just a porch that needs some work done to it.

The actual interior needs a lot of work. The kitchen really needs to be redone completely… I mean, the countertops were ORANGE… like from the 70s. The place also smelled really funky and everything pretty much was “original” including the windows.

That being said, both my realtor and I did see some potential in it. However, it would be best suited for an actual flipper, because it just needs too much work done. He guesstimated it needed around $50,000-$60,000 in renovations.

And I’m simply not interested in flipping properties (not yet anyway).

I originally put it on my list because it had pretty decent cashflow.

However, I won’t even rate this or provide the numbers on this one since it’s out of the running. It’s just not for me.

The Dark Horse Duplex

Here we go! A better name, no?

Okay, so this is an interesting one because while the listing says it’s only been on the market for just over 2 months, I’m pretty sure that it was listed longer but went off for a little while before getting relisted.

Because, I remember looking at it a long time ago and deciding that it didn’t cashflow well enough. Since then, I kept seeing the property along the list of my properties, just hanging around, but I always overlooked it since I knew that I had already deemed it as too expensive.

I finally decided to give it another chance since the market here has been so dead lately and I was simply running out of decent properties to look at.

Another thing that originally put me off the property at first was the fact that I’m pretty sure that this property never dropped in price. I’m guessing that a big reason for this is due to the fact that both sides were completely renovated 7 years ago, and the owner is probably wanting to get a certain number for it.

Anyhow, as we pulled up to the property there was a Doe (baby dear) in the front area who pranced away. This area of town, which is in a “Robin Hood” foresty/mountain area has a fair bit of deer. It’s about 5-minutes away from the ocean and is overall a pretty decent location. I’d rate the location about a 6.5/10.

The roof on this duplex is probably about halfway through its life or a bit thereafter. I really don’t know jack about roofs though, so I couldn’t really say. The backyard is very nice. It’s fully fenced except for the immediate sides to the building, and is very flat with a nice lawn and a few very large trees on the outer perimeter. It has a small wooded built-in playground and a nice tree with a rope swing, and is just a nice, sizeable back yard.

There are actually even 2 sheds, one for each property.

So why is this called the Dark Horse Duplex? Well, you already know that this one was lingering on my list of properties for a while, but never made me excited. Upon entering the place though, I was very happily surprised and it is now tied for my favourite property overall!

I knew from the photos online and the fact that the place was relatively recently renovated that it would be in pretty decent to good condition, but actually seeing it in person showed that it was in far better condition that I had thought.

While I wasn’t thrilled about the faux-wood laminate floors in some rooms, the rest of the property was very well done. It wasn’t a cheap reno, and was definitely more in the upper range of renovation… medium at worst.

The finishing’s are high quality. For example, the fridge is a Samsung stainless steel digital fridge, the kitchen faucet looks to be about a $150-$200 faucet, and that’s just the kitchen. The green sand casting process can achieve high production rate. The floor molding with green sand can produce castings of 100 to 200 sand boxes each day, e.g. about 100 pieces to 2000 pieces each day. Learn more about the advantages of green sand casting at Cast Technologies.

The rest of the house is finished just as well; the ceiling fans look to be pretty good quality, there are french doors by the dining room that leads out to the back yard. There is even mood lighting in the large master bedroom which was pretty neat (I was playing with it); it wasn’t just a simple slider but had several buttons.

And just other little things too like the exterior doors had those locks where you can use a key or enter a code instead.

Upstairs is where the bedrooms were. It is 3 bedroom and 2.5 bathrooms each side. The master has its own bathroom and even bluetooth bathroom mirrors. The other two bedrooms are smaller and simple, but all are done well. The bathroom even has a granite sink… it’s nice.

Walking through the place, it felt so different to all the other places because it was dramatically nicer. In fact, my realtor said that it’s actually nicer than the Ocean View Duplex that I keep crying about losing out on. It doesn’t have a view or garages like that one did, but it’s in a better location and is nicer inside.

We tried to see the other side of the duplex too, but the code that the listing agent provided didn’t work. Taking a look at the photos again online though, it appears that that side doesn’t have quite as good as finishing’s as the side we looked at. The finishing’s look to be decent, but definitely don’t give off the luxury feeling that the first side did.

Oh, and the side we looked at even had a nice small office! So rare! This place is perfect for families and/or working professionals.

It was great. Yet another property where I wouldn’t have to do a thing… and that’s a bit of an understatement, because it actually has a bit of a “wow” luxury factor.

So, here are the numbers on it:

-

- Monthly Cashflow (after all of my heavily padded expenses): $228.78

- (End of) Year 1 ROI/Cash-on-Cash Return: 6.53%

- (End of) Year 5 ROI/Cash-on-Cash Return: 25.78%

This is if I can get 20K off the asking price – which I don’t think is too unrealistic since it has never dropped!

This is also factoring in a reduced 7% vacancy and 5% repairs budget, since the rental rates I put on it seem to be pretty competitive, and the lower repair rate since it’s in fantastic shape.

So, that’s around a $43,000 return after 5 years factoring in equity and cashflow, a 25% ROI.

In 10 years, that’s a 52% ROI and a $56,000 return. However, this isn’t factoring in appreciation or rent increase. Plus, I will probably want to liquidate far before 10 years to move onto something bigger.

Overall, I rate this property an 8.5/10. I just increased it right now after writing this, heh… it’s now the leader!

It’s in fantastic shape, has a good location, it cashflows, and it has a good ROI.

So now what? Haha, I dunno. The last time I waited on a property I loved to drop, I lost out on it. I have to think more though…

The 2-House Property

I didn’t look at this one again, but just thought I’d provide my “new” numbers on it since it’s still among my favourites.

With my new numbers, I’m using a 7% vacancy rate (the tenants in the back have been there for 5 years!), 11% for repairs and maintenance, and 6% for CapEx due to the buildings age and condition.

-

- Monthly Cashflow (after all of my heavily padded expenses): $355.36

- (End of) Year 1 ROI/Cash-on-Cash Return: 5.55%

- (End of) Year 5 ROI/Cash-on-Cash Return: 18.89%

Damn… it still works, lol.

Decisions decisions…

How Putting a LOWER Down Payment on an Investment Property Can Yield a HIGHER Return

April 13, 2015 Posted by Tyler CruzSome or even most of you may already know this and even consider it as common knowledge, but it’s something that I didn’t really realize or consider before. And if I didn’t consider this before, then chances are some of you haven’t either, which is why I’d like to share what I’ve learned with you.

I was e-mailing back and forth with my realtor the other day when he asked me if I had checked if one of the properties I was looking at would benefit from a lower down payment.

This confused me.

After all, wouldn’t a higher down payment always be better since it means that I’m reducing the amount I’m borrowing, and hence the added interest?

When it comes to real estate investments, it’s important to consider various factors beyond just the down payment amount. While a higher down payment can certainly reduce the amount you’re borrowing and potentially save on interest, there are other aspects to consider. For instance, in certain real estate markets like the vibrant and dynamic City of Lights, there may be other investment opportunities that could yield higher returns on your capital. It’s essential to assess the local market conditions, property appreciation rates, and potential rental income if you’re considering an investment property. Exploring Sandycove Acres in Innisfil, I found a peaceful community with charming homes and friendly neighbors.

Conducting thorough research and consulting with real estate professionals can provide valuable insights into the best financial strategy for wealth management, helping you make an informed decision that maximizes your return on investment.

After playing around with the numbers for 2 hours for a potential home in hattiesburg ms, I realized that in my real estate market, it would make sense to put the highest down payment possible 99% of the time, at least from a return on investment perspective.

This is because investing in the real estate market here (which is considered to be one of the best source of automatic income for a person) doesn’t have very high cap rates (5% is average), meaning that 99% of income properties for sale here will not have cashflow high enough to the point where the point of balance shifts and it makes sense to put a lower down payment.

So, 1% of the time here, a smaller down payment would actually yield a higher cash-on-cash return (CoCR) than a higher down payment.

HOWEVER, I ran more numbers, and it seemed silly to me because in all the scenarios I ran, the end result would either be to put the HIGHEST down payment possible or the LOWEST down payment possible.

After some thought, I realized that this is because I was missing an important variable: cashflow.

And so, I took the cashflow factor and incorporated all of this by creating a Down Payment Optimizer tool into my Investment Property Analysis Super Spreadsheet in Excel.

My sheet is getting pretty damn advanced if I may say so myself. I’ve spent a lot of time learning VBA and creating and improving my spreadsheet to help me analyze properties and returns.

After countless hours (actually, I did count them but am too embarrassed to say just how long I worked on this here), I finally finished my Down Payment Optimizer tool.

It meets a minimum user-entered cashflow number before it decides what the optimal down payment would be to yield the highest CoCR.

Here’s a screenshot of it in action:

![KrI5acelVsW_rrS_1wiHRYhlhb6WsnZLHgLmL3AzvdI9mgZ_-IIMvZfRhZfBKy04_hQOB3w9I7fIg9t5aLm9yYKYolJ5x0liRl4UTcci1IOB=s0-d-e1-ft[1] KrI5acelVsW_rrS_1wiHRYhlhb6WsnZLHgLmL3AzvdI9mgZ_-IIMvZfRhZfBKy04_hQOB3w9I7fIg9t5aLm9yYKYolJ5x0liRl4UTcci1IOB=s0-d-e1-ft[1]](https://www.tylercruz.com/wp-content/uploads/2015/04/KrI5acelVsW_rrS_1wiHRYhlhb6WsnZLHgLmL3AzvdI9mgZ_-IIMvZfRhZfBKy04_hQOB3w9I7fIg9t5aLm9yYKYolJ5x0li.png)

In the scenario above, I took the 2-House Property as mentioned in my previous blog post and gave it around $500 more in gross revenue in order to show the benefits of this tool (otherwise, it would just give the highest down payment…).

As you can see, it calculated that the optimal down payment (rounded to the nearest $500) to be exactly $67,500.00, which would in turn result in a $501.32 cashflow after all expenses, which is just $1.32 over my requested cashflow, and yields a CoCR of 8.91%.

So, in such a scenario, it would make the most sense to put this exact down payment down, then look for another similar property and grab that as well, as the end cashflow would be higher over time (closing costs being the only negative factor).

Lower Vs. Higher: An Example in Numbers

For example, in the above scenario, let’s say I put down the highest down payment possible: 100%. Paying for it in full, it would have a CoCR of 5.75% and a net cashflow of $1,269.42.

Now, let’s take the optimal down payment as kindly given to us by my little handy new optimizer tool, a down payment of $67,500.00. This yields us a higher CoCR of 8.91%, but a lower cashflow of $501.32.

So, that’s $1,269.42 vs. $501.32 a month. It’s not looking good for the lower down payment right?

Well, that’s not fair, because we put down $265,000 in the first example, but only $67,500 in the second. That means that we could find 3 other similar properties with similar cashflow, and buy them! Okay, so we’re $5,000 short and this doesn’t factor in the added closing costs, but that’s nothing.

So, we have 4 properties now for the same price as paying for 1 in full, each cashflowing at $501.32 a month. That works out to $2,005.28 a month in cashflow, which is $735.86 more than if we had just paid the highest down payment possible.

That’s $15,233.04 vs. $24,063.36 a year. Quite the difference.

Now remember, this is only when I ran the calculation at $500 cashflow a month. Ultimately, you’d have to decide what would be best for your particular situation. For example, maybe such properties are nearly impossible to find, in which case you may want to put a higher down payment on. Or, you may have trouble being approved for 4 separate mortgages.

The point is, that you can really play around with the numbers. There’s a lot of “play” and wiggle room and you can get really innovative with how you work them. Real estate investing is largely about leveraging borrowed money (or so I hear), and so playing with the numbers is a huge part of it.

Affiliate Landlord: Hitting the Streets – Tour #3

April 11, 2015 Posted by Tyler CruzFirst, a very quick health update:

So, less than a week after posting that my health was much improved, I had a major relapse with my Meniere’s Disease and whatever the hell else is wrong with me.

I went to the doctor again and he’s a bit concerned, saying that there’s a bunch of “red flags”, and he scheduled me to get an MRI of my head. I’m waiting to receive something in the mail to know when my MRI is actually scheduled for – if it’s too far down the road, my doctor will get me expedited for a CT scan instead.

I’ve recovered well over the past few days, but there are still definite problems with me.

Anyhow, enough of the depressing stuff…

New Blog Post Category: Income Properties

I’ve added a new post category to my blog: Income Properties.

All my appropriate past posts have already been moved over, and all future related posts will be categorized as such as well. You can view my posts by category on the right sidebar of my blog.

The Third Tour

It’s been a while since my last physical tour of properties with my real estate agent. In fact, the last one was back on December 18th, 2014!

The market here, as I’ve said many times before, has just been a complete seller’s market lately and there’s been nothing half-decent to look at.

However, a very interesting property popped up a few days ago and I was pretty keen at looking at it, and so I made a list of 3 properties to go take a look at in person.

The Hospital 6-Plex

I wrote about this property a couple of posts ago, and I put it on my list of properties to look at as even though it didn’t cashflow with my numbers, it would cashflow if I managed it myself.

Unfortunately, it was just sold. I told you – seller’s market here.

To be honest though, I wasn’t all that disappointed. I mean, I was a little, but this place was always a bit ambitious for my first income property, and again – the numbers on it weren’t great.

I can’t wait to find out how much it sold for though…

I need it to drop again before I go take a look at it in person though

The School Duplex

I also wrote about this property in that same post.

So, I basically decided to look at this in person because I would only be interested in it if it was in superb condition, since it only cashflowed at $270 a month.

So, the result? Well, let’s just say that there’s a reason why you need to look at places in person.

First off, the building itself is a lot older than I thought it was. Both sides had an ancient looking furnace which neither side used; they used small space heaters instead. That actually isn’t a horrible idea either, since both sides were even smaller than I had thought – and I already thought they were small to begin with!

I mean, the trailer I lived in for a while as a kid was bigger than each side I think.

The kitchen on the first side was in really bad shape too.

The second side was resided by a hoarder – my first experience seeing a hoarder property in person! However, the side was actually the better of the two if you erase the clutter from your mind.

The interesting thing about this property is that it has a very large, flat back yard that is completely unused (just grass), and it backs onto a lane which means that it would be a perfect candidate to build a carriage house on. Unfortunately, since it’s already a duplex, local zoning laws wouldn’t allow for this.

Since the property is in poor shape and doesn’t cashflow too well, this is now off my list.

The 2-House Property

So, this property was the main reason I requested another tour with my agent.

It’s a new listing, only going live on the market a few days before booking the viewing, and is an older property. In fact, I knew it was old before we went to look at it, but I didn’t really realize just quite exactly how old; I thought it might be 1950’s or 1940’s, but apparently it’s likely at least 1930’s. The official age is listed as ‘unknown’.

And the age really shows itself in the construction. It’s lath and plaster interior for one thing – which is pretty much the norm in older houses here, and I’ve never done any repair work on with that before, but that’s not the end of the world. I would have to get in touch with a residential or commercial interior design service to make it somewhat modern.

The “basement” is a separate entrance and only about 5.5 feet tall. It has a gas water heater and furnace, and the washer and dryer are there as well – which must absolutely suck when raining and snowing (I live in Canada remember). It’s not nice down there and you don’t want to be there for long. In fact, as we were leaving, the bottom frame of the door was so rotten that it basically moved and nearly disintegrated. This was likely due to there being no awning over it, but it gives some hint as to some of the building’s condition and age.

I guess I should mention now, that this listing is interesting because it actually contains 2 separate houses on the same lot. The house I mentioned so far was the main house (house #1), and there is a slightly smaller one in the back which is legal non-conforming house.

What this means, basically, is that the house was built prior to municipal zoning changes, and is therefore allowed to grandfather in older laws that allows it to be legal now. I couldn’t tear it down and rebuild a new house there, for example. However, my agent told me that there are some loopholes that investors use here; primarily that you’re allowed to rebuild up to 75% of it at once without it being considered an entire teardown. Then you do the other 25% later, heh. All legal and compliant. ![109[3] 109[3]](https://www.tylercruz.com/wp-content/uploads/2015/04/1093_thumb.jpg)

So, this property is kind of unique in that it already has a carriage house in the back and is legal, making this a great real estate investment property set-up.

Getting back to what I was saying earlier regarding the old condition of the main house, there are two more downsides.

First, it’s situated in front of an old highway, so there is some noise from that, and also means that the access to the properties is through a narrow back lane which is a little bit sketchy and awkward.

Secondly, the area itself is definitely one of the least desirable areas in my city. It’s pretty comparable to the Hobbit House – if you’re up-to-date with all the properties I’ve been looking at. It’s maybe a 5% – 10% better location than there.

Apart from all these negative things, the main house was otherwise in good condition it seemed. In fact, I was surprised how nice the bathroom was for a house of that age. It was obviously recently renovated. Both properties have newer roofs on them through residential roofing repair, and if they are fiberglass, my realtor says they should be good for another 18 years. Searching for roofing companies near me. Call Overson Roofing in Arizona.

Both properties share a nice yard with some fruit trees, which is fully fenced and even split between the two properties. There’s even a single-car carport out back as well.

As a bonus, both properties actually have a half-decent ocean view; Google maps shows the distance to be only about 1200 feet from the ocean!

They both appear to be independently metered as well, and the tenants in the 2nd house have apparently been there for 4 years! That’ll cut my vacancy rates! In fact, I only put 7% in my numbers because of this. Even then, 7% is very conservative.

Here are all the numbers:

As you can see, even after all my possible expenses are covered (save for one-time closing costs; I’ll be adding those into my equations soon), this property has great cashflow, coming in at $531.62/month.

That’s a 3.54% ROI for life, not factoring in equity gain (once it’s paid off, it’ll be 5.74% ROI for life for example) or appreciation.

If I pay it off early, not counting early payment penalty fees, which I could easily do with a few great months of affiliate marketing, even after all my safety padding expenses, I’d be netting $861.42 a month for life, again not factoring in any appreciated value/rent. As my realtor told me, “Rents will increase with inflation. Your borrowing cost will decrease with inflation“.

It’s not $30,000 a month like you can make in affiliate marketing, but it’s also a very stable and dependable income I can expect each month, unlike affiliate marketing which is highly volatile and may only last one month.

So, on paper this property works. This is assuming $15K off the listing price, and not factoring in closing costs, but I’m also using a higher mortgage rate in my numbers.

I dunno. It’s old, and already in need of some repairs. Nothing major though. It’s not like the Oceanview Duplex that was sold before I had a chance to place a bid on – that property was in superb condition, no question, and cashflowed greatly. This one cashflows nicely, but is old.

Should I wait for something better to come around, or have I waited long enough? I’ve already been looking for around 8 months now…

What are your guys’ thoughts?

In my next post, which I’m going to start writing immediately after this one, I’ll be showing off some income property analysis tools I’ve been working on ![]()

I will most likely publishing it in 48 hours, so keep an eye out for it.