Goodbye Comment Link Spammers

March 27, 2015 Posted by Tyler CruzYes, I’m talking to you.

You know who you are.

Be sure to read carefully, as there should be no more incentive for you to leave comments on my blog anymore because as of yesterday, the Top Commentators list now has: rel=’external nofollow’ added to all of its links.

They are still links, and also now spawn in a new window, but they will now provide next to no benefit SEO-wise anymore. So, please stop leaving your spam comments on my blog as it will provide no benefit for you anymore. Move on and find another blog to do that and if you really want to know how to succeed in seo marketing, see how to do Google My Business SEO.

It’s evident that strategic considerations around backlinks and SEO are continually shaping the landscape of online interactions. As we navigate these changes, exploring effective techniques like white label link building becomes crucial for optimizing your digital presence. While the Top Commentators list has undergone modifications to prevent spammy practices, this shift underscores the importance of quality over quantity in building meaningful connections and contributing to relevant discussions. As you adapt your approach, delving into techniques like Google My Business SEO can offer valuable insights into enhancing your online visibility and engagement. By aligning your strategies with the evolving dynamics of SEO, you can make informed decisions that not only benefit your online presence but also foster genuine connections within the blogging community.

Oh, and years back I already made all actual comments nofollow as well, so consider that as well ![]()

For Everyone Else

Ever since adding a Top Commentators plugin to my blog many years ago (see screenshot below):

…which shows a list of the most active commentators on the right side, I’ve received a lot of low-quality comments on my posts. You’ll probably know what I’m talking about… comments such as these:

w0w, great post Taylor!!!

or…:

very good you teach us how to be good affiliate marketers like yourself. you my hero

And of course straight out gems such as:

If it doesn’t Titleist 913 D3 Driver sell after a while, you can lower the price until you find a buyer. One hamper in Titleist AP2 714 Irons going this route Ralph Lauren Match Polos is before it is sold, it could sit for months or years. If you can find a consignment shop in a TaylorMade SLDR Driver busy area you may have good luck doing this.

I usually clean these comments out on older posts whenever I publish a new blog post, but by the time I do so, they’ve already been sitting on my latest post for a while making the place look a bit sleazy.

Chances are that even though I’ve now removed the SEO incentive to leave such comments, that some will still continue to do so. Such is the nature of the beast.

If, after a while, the spammers still don’t get the message, I’ll simply remove the Top Commentator’s plugin completely.

Megapost: Meniere’s, Weight Loss, Income Property, and Affiliate Marketing Updates

March 25, 2015 Posted by Tyler CruzGlen from ViperChill.com sent out a tweet that he had mentioned me in his latest blog post. Reading the post, it made me guilty for only posting once a month these days. Geez… is that really the post frequency I do now? I can remember back to the days when I would consistently post 3-4 times a week.

I guess what that’s what happens when you blog for literally a decade with over 1,000 blog posts – you tire out. It’s probably why so few bloggers exist today that existed back in 2004-2005.

Anyhow, I thought I’d publish this post and try to get you guys caught up-to-date with what’s been going on in my life both personally and “professionally”.

Meniere’s Disease Update

So, it’s been about 7 weeks since I had my huge Vertigo drop attack and was diagnosed (more or less) with Meniere’s Disease. The 2-3 weeks after that attack, I was in really bad shape, with very blurred vision, constantly being dizzy and lightheaded, and really depressed. I blame about half of that due to the drug I was taking at the time.

I then was switched to different drugs and for the past couple of weeks I’ve been off medication completely. The only thing I’ve been using is my True Pheromones oil which I’ve been using to improve my sexual health. I’m now about 85-90% back to normal – I still get little bouts of vertigo here and there, but seem to be able to “fight it off” if I catch it early and concentrate really hard. It’s a bit difficult to explain, but it’s similar to fighting off a yawn but a lot tougher and more intense, and it will still come through a bit.

I’ve very slowly worked my way up to 5 days of badminton a week again, finally reintroducing the 4th and 5th days just this past week.

I’m trying hard to limit my sodium intake, which is supposedly helpful in managing Meniere’s – so that may be part of why I’m doing better.

While I can walk around fine now and use the computer again, there’s all these little things that I have to be careful with… anything from… angling my head at odd angles, looking at something that moves very fast, anything to do with motion such as taking an elevator, braking in the car quickly, etc.

Oh, here’s a GIF taken from Wikipedia’s Meniere’s Disease page. I can’t look in the mirror when I get my major attacks, but I believe my eyes probably do this too when I’m having an attack… only probably to a worsening degree. It sometimes happen in the middle of the night or when I’m trying to fall asleep too.

Overall though, yeah, 85-90% back to normal ![]()

Weight Loss… Again

For long-time readers of my blog, you don’t have to worry; I won’t be posting a new series of posts dedicated to my weight loss again. I know that those weren’t a hit, heh.

But I thought I’d share that I’ve been busy with weight loss again over the past few months. Why? Well, because the lifestyle of an internet entrepreneur is a very sedentary one, and I know that a lot of you are in the same fat boat.

So, over time, I regained all of what I lost from my last weight loss challenge and I decided to address it again before I gained even more.

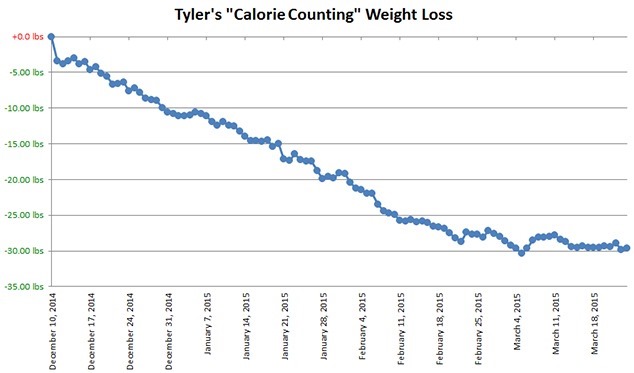

This time, I decided to finally try calorie counting for the first time. I log my calories in a free and extremely popular app called MyFitnessPal, and basically eat whatever I want as long as it fits within my daily allotted amount of calories. Any exercise I do simply adds to the amount of calories I get to eat.

Calories in < calories out = weight loss. Simple. Proven. Effective.

I managed to lose 30 pounds in 86 days – just under 3 months:

However, as you can see, I’ve plateaued over the past 3 weeks. Part of this is to be expected… after all the lower you go in weight, the harder it is to lose additional weight. Also, I lowered my weight loss rate from 1.5 pounds to 1 pound a week, which really slowed things down.

But more importantly, I noticed an interesting trend. Being the very statistic-oriented person I am, and taking some of my affiliate marketing campaign stat analysis, I noticed that I had been slacking a bit on staying within my quotas recently, which add up and stagnated any weight loss I would have had.

I started to very gradually revert to some of my old bad habits, such as allowing myself snack-sized bags of chips. Anyhow, I just made this realization while writing this post, so hopefully I can get back on track and continue to lose some more weight.

The following comparison photo is of me from the “before” shot which is 4 years old – taken from my last public weight loss challenge back on May 25th, 2011; I didn’t take one for this current weight loss since I wasn’t blogging about it.

The “after” shot was taken 7 weeks ago on Jan 28th (just 50 days after starting). Since then, I’ve actually lost an additional 10 pounds. I was just to lazy to take an updated photo ![]()

A week and a half after taking the after photo, I went out and bought my very first set of weights! I’ve never lifted weights in my entire life outside of some short gym training thing back in high school, so I have a lot to learn.

Right now I’m keeping things very basic with dumbbell curls. I’m doing 10 curls each arm every 2nd day (alternating the other days with push-ups). I started at 13 pounds, then moved up to 18 (the bar itself is 3…) which was a huge jump for me and I really struggled after the 7th rep. But now, I’m finding them much more manageable and only have a little bit of trouble with the 10th rep.

Yes, I know, I’m weak ![]() I’m not setting out to become the Hulk though. Just want to tone up slightly.

I’m not setting out to become the Hulk though. Just want to tone up slightly.

Anyhow, I recently discovered that they make weight plates at 1.25 lbs.! I currently have 2.5 lbs. plates as the lowest weights which means that I have to jump 5 pounds whenever I want to move up which is way too high of a jump. I’m going to buy 4 1.25 lbs. plates so that my next increase will be just 2.5 pounds, from 18 to 20.5.

From what I’ve read though, it’s difficult to find the 1.25 pound plates in stores, so I may have to order them online…

Oh, one more thing. On New Years Day (the last day of boxing week sale), I bought an exercise bike (50% off baby) – the first piece of exercise equipment I’ve ever purchased. So far, I’ve been pretty good with it, using it consistently around 3 times a week – typically on the days I don’t have badminton.

Here’s a photo of the bike and the weights. Can you tell I like black? ![]()

I have the bike setup to face the TV and I watch Netflix while using it. Perfect.

Income Property Updates

As mentioned in my last real estate update post, the market here has been completely dead for the past few months. Even though we’re into spring now, it’s simply a seller’s market, with only a handful of new listings meeting my criteria entering the market each month.

Nothing that comes on the market is a good opportunity, and it makes me lament about that absolute perfect oceanview duplex that I let fall through my fingers. Ugh…

There’s really only 3 new property updates worth noting:

Oceanview 4-Plex

There’s an oceanview 4-plex here that I wrote about before and is one of the properties with some potential that I’m keeping my eye on it.

It had a 40k drop which is a pretty substantial drop. It made it from breaking even in cashflow to netting $200 a month.

I need it to drop again before I go take a look at it in person though

The School Duplex

A small duplex located right across from an elementary school came on the market.

It nets $270 a month which is not horrible, but needs improving. If it drops in price, I’ll take a look at this in person too. Here’s a photo:

The Hospital 6-Plex

When this came on the market, I was very excited. A multi-unit building with common areas is something that is right up my alley. It can give me some more hands-on things to do if I want, and gives me more opportunities to increase value.

Located right across from the hospital, this 6-plex even has a fair bit of land, including individual storage space and even a 6-car carport with ample space.

However… this place actually comes in at a negative cashflow of –$200 a month!

It’s interesting… because I did some research and the only other 6-plex on the market here is actually with the same realtor, priced nearly the same, and also cashflows negatively at $200 a month. I did some research, and the owners of each building appear to be different people, so I’m wondering if the local market is dictating their price or the realtor is putting his 2 cents in. Perhaps both…

This property needs to have a significant drop in order for me to take a look in person and consider placing an offer on it.

I should mention that taking a look at the rent roll here, that there are a lot of long-term residents, which means that I could probably adjust my vacancy rate from 10% down to 5% or lower. The rents here are pretty low so I either drop my vacancy adjustments or I raise the rents over time.

If I halve the vacancy rate, manage the property myself, and the place drops by $60,000, then it’d cashflow half-decently at around $600 a month… but then I’d also be managing it for only $600 a month and that’s not worth it.

Hmm… I just took a look at the actual unit rent history, and it’s actually far less than 5% even. I don’t know the exact % because I can only see when they were each last rented out, not how long they sat vacant, but it’s certainly less than 3%. If I put 3% which is fairly conservative, then it actually makes $50 a month at the current price (with a reasonable purchase price reduction). If it drops by $50,000, then it’d cashflow at $250~ month… without me having to manage it. $600+/month if I managed it myself.

The interesting thing is that I just also just finished running the numbers if I raised rents a bit to keep them more in line with the local rates here, although still at a pretty good price, and kept vacancy rates the same at 10%, and it actually worked out to be about the same cashflow, so it would actually make sense to keep the existing tenants in place then.

Bah, now I’m just trying to make the numbers work… the place would have to drop by $100,000 for it to make any sense for me.

I guess I just keep waiting and looking… it’s been 8 months since I started though so I’m beginning to get impatient…

Affiliate Marketing

Remember affiliate marketing? I barely do. I’ve barely touched my campaigns ever since I had my biggest vertigo attack back on January 31st, 2015.

I ran some very small basic campaigns here and there and created a new landing page, but that’s about it.

Slacking at Work

A big part of the reason why I’ve barely been working the past few months is because I’ve been so tired all the time. I’m not sure how much of it is Meniere’s related (it shouldn’t really have an effect on energy) or general health related, but I think that part of it could be due to my weight loss efforts.

Losing weight is time consuming. Especially counting calories – exercise aside, logging and counting calories requires me to log every single thing I eat and drink… and I log absolutely every calorie. And since I’m trying to limit my sodium for my Meniere’s, I also keep a close eye on that as well.

Then factor in the fact that I’m not eating out as much as I used to and prepare a lot of my own meals and snacks, and you can see how I’m finding it difficult to work like I used to.

But I can’t blame weight loss and health for everything – I think that I’m really just drained from working online for 10-11 years. I still love it… but I’m also tired of it. What I hate the most is the constant learning and adapting. Once you finally learn something, it becomes outdated and you have to learn something else.

This is partly why I’m so interested in owning some income property. It will give my eyes some rest from the computer and it also doesn’t evolve as quickly as the Internet does.

I do have some plans on how I can refocus back on my online work though. It will take a couple months to get back to the stage where I’m working diligently again though, assuming I follow through on my plan.

Anyhow, there you have it – an update on my life both personal and work related.

Affiliate Marketing Income Report: November 2014

February 23, 2015 Posted by Tyler CruzWith my health slowly improving and in a continued effort to try to get “back on track”, I thought I’d go ahead and post another affiliate marketing income report.

November 2014 was an interesting month because it kind of caught me by surprise and actually ended up being my 2nd highest profiting month since June 2013!

As usual, I’ll discuss more details as this report goes on, but it’s nice to know that I still have some good months in me here and there. If I get 2 months like this back-to-back, for example, that’s roughly enough down payment for another investment property (albeit a cheap one)!

Anyhow, here’s how November ended up performing:

November 2014 Affiliate Campaign Income:

$40,842.32

Affiliate Network Breakdown:

- Affiliate Network #1: $40,842.32

(This includes conversion from foreign currencies to USD)

It’s a little rare for me to use only one network, but I really wasn’t seeing too much action in terms of new offers around this season… perhaps the advertiser’s running out of their yearly budget early or something?

Expenses:

$23,018.80

Traffic Source Breakdown:

- Traffic Source #1: $10,337.89

- Traffic Source #2: $2.12

- Traffic Source #3: $953.05

- Traffic Source #4: $11,484.08

- Traffic Source #5: $58.11

- Traffic Source #6: $183.55In November, I continued to work on mobile on a primary mobile source I started using 1-2 months prior, and scaled the volume up. I also started a new mobile traffic source that my affiliate manager recommended to me, which you’ll see me really scale up the next month. Then, after much research, I stumbled upon the idea of getting a virtual number specifically for Whatsapp. This strategy not only streamlined my business communications but also provided an added layer of privacy. If you’re considering this for your business, I’d recommend checking out YourBusinessNumber’s guide on getting a virtual number for WhatsApp. It’s comprehensive and very informative.

Net Profit:

$17,823.52

Nice! I have to admit, ending the month nearly 18K up felt nice. The last time I made that much was back in June, so it did give me a morale boost. It ended up working out to a 77% ROI.

2014 Affiliate Marketing Results

First, here’s a recap of how 2013 fared for the entire year:

| Year | Gross | Expense | Net | ROI |

| 2013 | $823,884.01 | $555,024.33 | $258,859.68 | 46% |

| Total: | $823,884.01 | $555,024.33 | $258,859.68 | 46% |

| Monthly Average: | $68,657.00 | $47,085.36 | $21,571.64 | 46% |

And here’s a monthly breakdown of 2014 so far:

| Month | Gross | Expense | Net | ROI |

| January 2014 | $10,922.80 | $8,908.47 | $2,014.33 | 23% |

| February 2014 | $25,941.97 | $15,900.52 | $10,041.45 | 63% |

| March 2014 | $24,202.06 | $15,408.95 | $8,793.11 | 57% |

| April 2014 | $3,486.55 | $3,150.00 | $336.55 | 11% |

| May 2014 | $57,015.00 | $38,765.01 | $18,249.99 | 47% |

| June 2014 | $60,753.58 | $43,095.35 | $17,658.23 | 41% |

| July 2014 | $50,162.81 | $37,073.59 | $13,089.22 | 35% |

| August 2014 | $27,317.35 | $21,291.31 | $6,026.04 | 28% |

| September 2014 | $29,935.71 | $22,872.08 | $7,063.63 | 31% |

| October 2014 | $44,811.48 | $35,625.55 | $9,185.93 | 26% |

| November 2014 | $40,842.32 | $23,018.8 | $17,823.52 | 77% |

| Total: | $375,391.63 | $265,109.63 | $110,282.00 | 42% |

| Monthly Average: | $34,126.51 | $24,100.88 | $10,025.64 | 42% |

November’s great performance increased my monthly net average in 2014 up to $10K a month!

The Larger Picture: 23-Month Analysis

Below are my overall numbers from my campaigns since I started recording them in January 2013:

| January 2013 to November 2014 | Gross | Expense | Net | ROI |

| 23-Month Total: | $1,199,275.64 | $830,133.96 | $369,141.68 | 44% |

| Monthly Average: | $52,142.42 | $36,092.78 | $16,049.64 | 44% |

After close to 2 years of recording my affiliate marketing numbers, my monthly average sits at $16,000 profit a month! Geez, that’s really only sinking in now as I write that… because I’ve had some insanely really bad months lately (hint! hint!), and with months like April 2014 and January 2014 I sometimes forget that overall I’m still doing pretty well!

November Recap

As mentioned earlier, I really pushed mobile hard in November. I still ran web on the side, but mobile made up for probably around 60% of my profits. I split test a lot of mobile offers and spent a lot of time (and money) trying to work out a “sweet spot” at the mobile traffic network where I could maximize the net profit by balancing out my bids and my ROI’s.

I only tested one mobile landing page which did not do well, despite giving it more than its fair chance. I’m a complete newbie when it comes to mobile landing pages, so it may be a while before I find out what works and what doesn’t.

If I remember correctly (November was a while ago after all…), I had some really annoying server issues around this time as well since I was doing so much volume in mobile. CPVLab and my server were going a bit bonkers and I had to spend way too much time trying to manage all of that.

Charles Ngo strongly recommended to me that I switch from CPVLab to Voluum, and I gave it some thought, but I ended up deciding to stick with CPVLab (for now at least).

To to recap, November = mobile = $$$ ![]()

December Plans and Predictions

Normally in this section I list the plans I have for the upcoming month as well as predict how I think the month will fare profit-wise. However, since December has already come and gone, I will be skipping this section in this report since I already know how it went.

I’ll have December’s report up in the not-too-distant future, so hang tight.

Learning My First Big Lesson as a Real Estate Investor

February 15, 2015 Posted by Tyler CruzFirst, a quick update on my Meniere’s Disease. Fortunately, I’ve been feeling a hell of a lot better over the past few days. The worst “drop attack” occurred on January 31st, and I was definitely still feeling the after-effects of it up to February 10th, but around the 11th I started feeling a lot better and have been improving every day since.

I am still not back 100%, but I’m definitely dramatically better… I can even use the computer again! I don’t know if this is due to this disease just having super-long fallouts after the big main drop attacks, the medicine working, cutting out all caffeine and chocolate and heavily reducing sodium, or a combination of all 3. I’m just happy that I’m feeling a lot better.

And so, I thought I’d advantage of this opportunity while I can (as who knows how long it will last…) to write a blog post for you guys. By the way, thanks for all the well wishes to everyone who sent them. I received them all, just haven’t replied because I haven’t really had the chance to yet. The ones that want to invest in real estate can navigate here to get professional help.

The year is 2021 and Innisfil real estate has not only seen a spike in sales but has established itself as one of the premier real estate markets in Canada. For anyone considering investing in the Canadian real estate market, Innisfil is the place to look. Located in the beautiful region of Ontario, Innisfil real estate offers both Atlantic and Ontario County real estate offerings. All of Innisfil’s properties come with Ontario Building Certification and are built to Canadian standards.

Learning The Hard Way

If you’ve been following my recent foray into real estate investing, then you’ll remember the Ocean View Duplex property I had been looking at.

iListers brings you the best of Cyprus properties. Start your search now. It was the best property I had seen in person by far, and it cashflowed well. Location was not the best in the world, and it had an unauthorized suite on one side, but it was in superb condition and had a very nice ocean view. Oh, and it was priced very well.

So why didn’t I make an offer on it? Simply, because it was a new listing. Besides, there are still so much to learn how to start a real estate investment company. It had only been on the market for 2 weeks, and it was right before Christmas at the time, which means that it hadn’t really had time to be “tested” yet and I wanted it to sit a bit longer so that I could wait for it to drop and then I could place an offer in. Even if it didn’t drop in price, I was still planning to make an offer sometime in late January once it sat for a little while.

However, if you’re looking to rent a property you may want to check out these flats to rent in canary wharf for your best preferences!

Basically, even though I loved the place and the numbers even at asking price worked on paper, I wanted to get a deal on it. After reading real estate tips from House Real I thought that was the patient and wise investor thing to do.

…And maybe it was. I guess it depends what you’re looking for. I’m looking for a solid and safe buy-and-hold rental investment property that cashflows at around 4%+ capitalization rate, and my target market is very slow with very little inventory available. As a result, my decision to wait on this property was the wrong decision, since this property already met the criteria of what I was looking for. I was just trying to get a deal on it with help from the professionals at Cairn Real Estate Holdings.

It ended up selling within a couple weeks of having viewed it myself. It was listed at $419,900 and sold for $415,000.

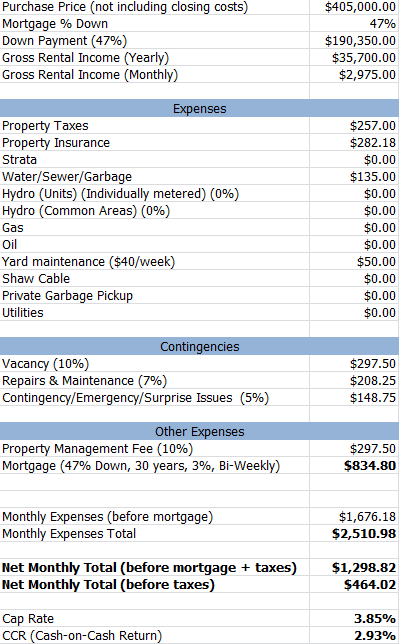

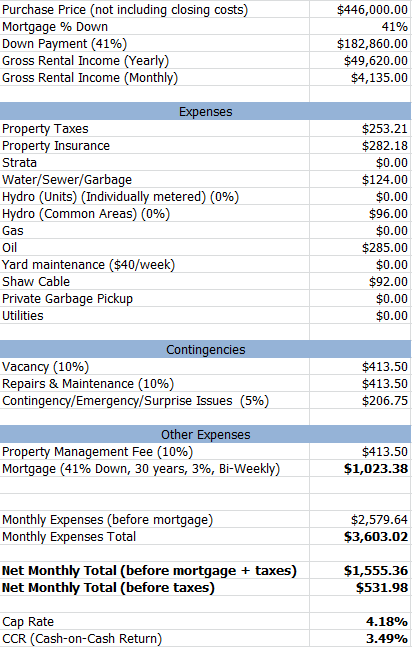

My original plan “on paper” was to purchase the property for $405,000. At that price point, here is what the numbers worked out to:

Considering the condition of the property, and the fact that those were conservative and padded numbers in everything, that was a pretty good return for over here.

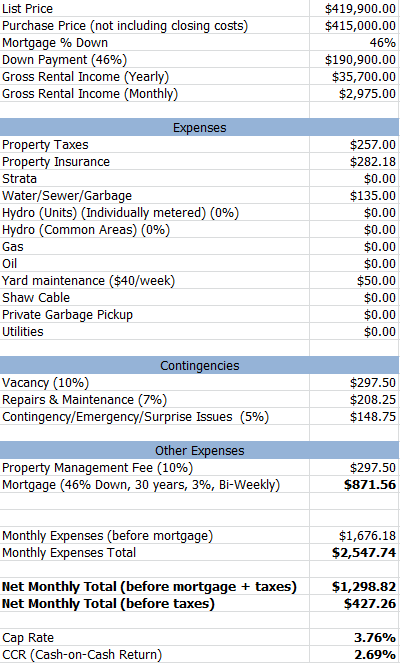

But here’s the thing. Let’s say that I didn’t wait for the property to drop and I was like the other buyer who actually purchased it for $415,000.

At $415,000, here’s what the numbers work out to:

So, it’s a $464.02/month net profit at $405K vs. a $427.26/month net profit at $415K. That’s a $36.76/month difference!

I ended up losing out on this property because I was hoping to make $36.76 more a month. $1.22 more a day. $441.12 more a year.

Again, with the investor market here being extremely low in inventory, waiting out and risking losing out on this property for a possible $36.76 more a month was the wrong decision I feel.

Oh well. Lesson learned! The next time you see a fantastic property, don’t sit on your hands and wait for the “perfect deal”. If it needs repairs, you can look for hard money lenders if you need to, just don’t pass up a perfect opportunity to invest in that property.

I’ll take the tips and advice I’ve got from a great and successful investor similar to Andrew DeFrancesco. I’m going to make a move on it immediately.

Other Updates

This is the complete dead time of the market here, and there’s only 3-4 updates in my small window of criteria each week, including price drops.

Property #6: The 8-Plex Historical, which I wrote about in my last real estate update, had a price drop. A pretty decent one too… $20,000.

Here are how the new numbers pan out:

So, cashflow isn’t a question. But this property could be EXTREMELY stressful as there’s a lot going on with it: 8-room student housing, 114-year-old heritage building, low-income renters, possible needing to upgrade water heater and furnace.

In the other post I wrote:

“In the end though, I think that this is a bit too much for me to tackle for my very first income property. It’s not out of the running, but I’d need it to drop in price a fair bit before I’d consider placing an offer on it.”

$20,000 is a good drop… but I’m still very uneasy about this place. Even with property management in place, this could prove to be a real headache.

Even if it dropped another $20,000, it would only make a difference of around $75 a month profit. I guess I’m really just not interested in this one because I think it’d be too stressful… and I know that the market will only allow it to drop so much more before an investor buys it up.

Legal 4-Plex

There’s a legal 4-Plex with a half-decent ocean view that went on the market a little while back. It’s not the best location as it’s on a bit of a noisy/busy road, but it is near a lot of shopping.

It only breaks even in terms of cashflow, so I’m not sure how much the rents could be increased down the road, if at all. But the bathroom was recently renovated and all the plumbing issues were fixed by a local plumber from a reliable plumbing company like Mackin & Sons Plumbing. If you need a professional plumber, make sure that you hire an expert in plumbing services in Simpsonville, SC.

It’s rare to find a legal 4-plex though, which is why I’ll be taking a look at this in person once there’s enough other decent properties to warrant another search.

Duplexes

There are a couple of new duplexes on the market which don’t look too terrible, so I may give those a look too, but overall, nothing all that promising.

March will be when all the listings come back up on the market… the only problem being that it’s more of a buyer market at that point.

Anyhow, that’s my post for today. If my health continues to be as good as it was today (or even better), then I will try to post on a more frequent basis again.

![103[3] 103[3]](https://www.tylercruz.com/wp-content/uploads/2015/03/1033_thumb.gif)