Affiliate Marketing Income Report: May 2014

July 27, 2014 Posted by Tyler CruzWell, I better get May’s affiliate marketing income report up before I start to fall too far behind on them again.

If you remember, April 2014 did not bode well, netting only $336.55. And then I didn’t post another income report until just now, a month later. Things must have continued in a downwards spiral, right?

Wrong. As explained in my previous blog post, I had just been busy looking into real estate investing. My affiliate campaigns did just fine in May, but even if they hadn’t, it’s not like I would purposely try to avoid posting about it.

So how well did May do? Let’s take a look:

May 2014 Affiliate Campaign Income:

$57,015.00

This was actually my highest grossing month in 10 months!

Affiliate Network Breakdown:

- Affiliate Network #1: $41,218.00

- Affiliate Network #2: $39.00

- Affiliate Network #3: $12,839.00

- Affiliate Network #4: $2,919.00

Expenses:

$38,765.01

Similarly, this was also my highest month of expenses in 11 months (not so proud of that one, heh). I also ended up using a ton of different traffic sources in May, 8 in total (more on that later):

Traffic Source Breakdown:

- Traffic Source #1: $29,994.89

- Traffic Source #2: $8.40

- Traffic Source #3: $12.45

- Traffic Source #4: $843.62

- Traffic Source #5: $288.46

- Traffic Source #6: $334.73

- Traffic Source #7: $2,562.78

- Traffic Source #8: $4,689.68

Net Profit:

$18,249.99

Wee! My highest netting month in 10 months (July 2013). For those curious, that works out to a 47% ROI.

2014 Affiliate Marketing Results

Now that I’m into my 2nd year of these affiliate marketing reports, here’s a recap of how 2013 fared for the entire year:

| Year | Gross | Expense | Net | ROI |

| 2013 | $823,884.01 | $555,024.33 | $258,859.68 | 46% |

| Total: | $823,884.01 | $555,024.33 | $258,859.68 | 46% |

| Monthly Average: | $68,657.00 | $47,085.36 | $21,571.64 | 46% |

And here’s a monthly breakdown of 2014 so far:

| Month | Gross | Expense | Net | ROI |

| January 2014 | $10,922.80 | $8,908.47 | $2,014.33 | 23% |

| February 2014 | $25,941.97 | $15,900.52 | $10,041.45 | 63% |

| March 2014 | $24,202.06 | $15,408.95 | $8,793.11 | 57% |

| April 2014 | $3,486.55 | $3,150.00 | $336.55 | 11% |

| May 2014 | $57,015.00 | $38,765.01 | $18,249.99 | 47% |

| Total: | $121,568.38 | $82,132.95 | $39,435.43 | 48% |

| Monthly Average: | $24,313.68 | $16,426.59 | $7,887.09 | 48% |

That helped a lot. Basically, May stepped up to the plate and completely made up for April’s poor performance.

Taking a look at my Excel spreadsheet, since I started recording my numbers in January 2013, my overall average month net profit (spread across 17 months) is $17,546.77.

I might actually start including that metric in future reports as it’s actually pretty meaningful.

Net Profit Projections

This is just a reminder that I decided to cease including my graphs for projected future numbers, as I decided that there really are no trends when it comes to affiliate marketing. It’s simply far too volatile, and so much of it is out of your control.

May Recap

Okay, so I finally caught up close enough on these reports that I can actually remember what happened during the month.

By the beginning of May, I had finally caught up with all my other work and was able to once again focus on my campaigns. With April having gone so incredibly sour, I decided to revisit every single one of my traffic sources I had ever used in the past, no matter how old.

A good majority of these sources had either disappeared or merged with another company, so I wasn’t able to use them anymore. A good chunk of the ones that did remain, I checked my old stats with them in CPVLab to see how they performed. If they performed terrible, I didn’t try them again. If they had potential, I gave them another shot.

This is why you see 8 different sources of traffic in my expense breakdown earlier in this post. Most of them did not do very well, but one old sources did.

In addition, I tried a new traffic source as well. It started off AMAZING. The first week was crazy and I was on pace to scale to $2,000+ a day profit… I was thrilled. But then, for some still unknown reason, my CTR dropped like 10-fold literally overnight and everything went to crap.

I have since did a lot of testing to try to figure out this new traffic source and why my CTR dropped, but never did get things back up to what they were in the first week. I have learned a lot about the system since then though, and am improving on it. It still has potential…

I also ran some new offers during the month which performed very well. I have to credit those new offers for sure.

So, what to take away from this post? Why not try what I do every 6 months or so – go back and revisit all your old traffic sources and give them a try again. Your skills will have improved since you last tried them, and you may have better converting landing pages now and higher payouts. Competition may have dropped on the traffic sources, and they may have new features. Give it a try.

June Plans and Predictions

Normally in this section I list the plans I have for the upcoming month as well as predict how I think the month will fare profit-wise. However, since June has already come and gone, I will be skipping this section in this report since I already know how it went.

Stay tuned to see for yourself!

So I’m Thinking of Investing $200,000…

July 24, 2014 Posted by Tyler CruzAnother 3 weeks without a post. What happened?

As per usual, I’ve been here all along. I didn’t go on vacation, there wasn’t an emergency, and everything has been going along as per usual.

After tending to my e-mails and morning maintenance of my campaigns, I’ve been spending the rest of my work time looking at getting into the investment real estate business – specifically buy-and-hold rental properties. I’ve gotten some advice from great companies, like SoFi.

I’ve made my living for the past 10 years entirely from the Internet by working for myself, and have done moderately well as a result. So why the sudden urge to jump into a completely different industry?

Relative Stability

Simply put, affiliate marketing is incredibly unstable. I can literally go from making $30,000 profit one month to $0 the next. In addition to such variance, being an affiliate marketer requires time and effort (and luck) in order to make money. You have to keep finding new profitable campaigns to run. You can also read this press release titled “Captor owns a 51% interest in One Plant California which operates six (6) retail stores in California at the moment” to learn how businesses make their investments.

While real estate investment is far from passive income in the beginning, the more experienced you are in it, the more passive it will eventually become. Plus, once the properties are paid off, then you will basically get a guaranteed return for the rest of your life.

This simple fact is the main driving force for me. Good luck finding a guaranteed lifetime (literally lifetime) return on your investment online for which I recommend first checking with experts at this finance services manchetser.

Now, I understand of course that the real estate market can and does change, and you can get bad tenants and all that, but compared to online, real estate is laughingly stable. However, investing in the best gold ira is the best way to ensure that your saving will increase.

Keep in mind too, that I’m in Canada, and our real estate market is a lot more stable than the US due to having a lot more stringent lending rules.

Lastly, it’s always good to diversify things a bit. After all, I’ve only been doing affiliate marketing as my primary income for a couple years now.

A Whole New World

My only experience with real estate has been through the purchase of a condo in which I lived for around 7 years, the sale of it, and then the purchase of a house.

While I’m very comfortable with real estate for personal use now, it’s a whole different ballgame as an investor. Lending rules change slightly, there are legalities, tax things, and of course tenants. Real estate agents can help first-time homebuyers find north myrtle beach homes for sale and ensure that the transaction goes smoothly when applying for home loans.

Now, I want to say that if I do go through with this, that I’ll 100% be using a property management company to handle all of the tenant stuff. They take 10% of the rental cost as their fee and handle pretty much everything that you as a landlord would have had to do yourself including finding, screening, and processing tenants and even providing 24/7 phone support for things like needing to get an emergency plumber in the middle of the night.

Even with a property management company to take on most of the responsibilities of being a landlord though, there’s still a lot of work and stress involved. My hope though is that I can take care of most of this work beforehand during the actual finding and purchasing process.

A Lot to Learn

I joined an online real estate investment community called BiggerPockets which I highly recommend. It contains a blog run by multiple people, a forum, some tools, and a podcast and is a really great resource.

I’ve already learned a fair bit so far, including a lot of the basics such as the 50% rule, the 1-2% rule, and cap rates.

In addition, I went and scoured Amazon for the best related books and added 13 to my cart:

Total cost: $192.69.

I have yet to actually order them though as I’m a bit worried that the majority of the content may be US-specific and not apply to me as a Canadian. I understand that a lot of the underlying logic could be useful, but I do know that a lot of these types of books are pretty country-specific.

Also, I’m not quite sure if I’d actually read them or not so I’m holding off on ordering them for now. They’re in my cart ready to go though for when I am.

Lastly, I’ve reached out to a number of real estate professionals locally to inquire about things further.

Still on the Fence

I am waiting to hear back from my accountant’s firm as we are going to discuss real estate investments versus other investment options available; I’m simply waiting for them to finish my corporate year-end so that I can book some time afterwards to discuss things. In fact, I’m also considering investing in the stock market by going to stocktrades because I know how much one can earn through stocks.

This will play a very large factor in my ultimate decision on whether to proceed or not. If you’re investing in crypto and want to earn money on your cryptocurrency balances, you’ll need to work with a trustworthy service. Additionally, researching the spa coin price prediction can help guide your investment strategy. Read this Celsius review to see if it is a good fit for you.

My Plan

I am not interested in flipping houses.

My plan is to purchase buy-and-hold rental properties, with the idea of parlaying some of my affiliate marketing profits into more slow-and-steady long term offline investments.

I have not quite decided if I want to go the route of apartments or duplex’s, triplexes (multifamily) – there are so many pros and cons to both.

I have also not fully decided on if I’ll buy a place outright or if I’ll get a mortgage (or 4). That will depend purely on the numbers. However, I do not plan to leverage my properties in order to purchase more. I want to be more conservative (at least in the beginning) and pay off the property(ies) before I add more to the collection.

I’m also taking into consideration a Regulation Crowdfunding Money Raising service so I won’t have to shoulder the whole financial requirement of this real estate investment.

The Local Climate

Now, what may surprise a lot of you is that my local city (I would only purchase within my city or nearby as I’ve lived here for close to 25 years and know it well) isn’t the best place for a real estate investor.

Cap rates seem to be around the 5.5% range, and it’s very difficult to find a 1% deal here let alone 2%.

On the plus side, property taxes here aren’t as high as in some of the places in the US where property is dirt cheap, and my city doesn’t have a lot of slums. There are some crappy areas, for sure, but generally the city is fairly stable when it comes to housing.

For those curious, here are a few investment properties in my city (actual ones I’m interested in):

Four-plex (technically duplex with 4 doors)

- Price: $509,900

- Yearly Net Profit: $30,389 (5.9% cap)

- Recently renovated

- Somewhat sketchy area of town

- Price: $689,900

- Yearly Net Profit: $38,000 (5.5% cap)

- An actual apartment building

- The low net:gross ratio makes me think that it’s very well maintained

- Extremely sketchy street, but downtown…

- Price: $259,900

- Yearly Gross Income: $20,400 (Assuming 75% net, that’s 5.8% cap)

- Drove past it a couple days ago, looks a bit run down…

- A bit worried about the basement

- Price: $429,900

- Yearly Gross Income: $45,000 (Assuming 75% net, that’s 7.8% cap)

- Very sceptical about the stated income…

- Looks to be in decent-good condition

- On a street with a bunch of duplexes

Mediterranean & Baltic (Cheap Apartments)

- Price: $64,900

- Yearly Gross Income: $7,800 (Assuming 75% net, that’s 9.0% cap)

- Old building (No idea as to its condition)

- A little sceptical of the stated rent

- A bunch of these units are for sale. Could buy a few outright…

- Price: $134,000

- Yearly Gross Income: $10,800 (Assuming 75% net, that’s 6.0% cap)

- Penthouse

- Nice apartment in good shape

- I actually really like the look of this one, just saw it now, heh

Feedback is Welcome!

So, what do you think?

If I do go ahead with this, I’ve already played around with the idea of adapting my blog to incorporate my real estate investments as well. I can see me doing posts of “before and after” photos of my rentals after some basic upgrades, for example ![]()

I KNOW that a lot of you will have strong opinions on this one. Real estate is just one of those things that everyone likes to chime in on ![]()

I’d especially be interested to hear from other affiliate marketers who have invested in real estate.

Affiliate Marketing Income Report: April 2014

July 1, 2014 Posted by Tyler CruzApril’s Report! Only one more report to go and then I’m finally up-to-date!

Unfortunately, that’s the only good news you’ll see in this report, as April ended up averaging only $11 net profit a day!

Ah, the highs and lows of affiliate marketing. When things are good, things are really good. When things are bad, things are really bad. The swings are almost as bad as in poker, only it’s a lot harder to go into the negative territory in affiliate marketing as you have a lot more control over what happens.

In fact, that’s why you have yet to see me finish a month in the red.

With that said, let’s get this over with… ![]()

April 2014 Affiliate Campaign Income:

$3,486.55

Ha! April 2014 was by far the lowest grossing month I’ve done ever since starting these reports in January 2013.

Affiliate Network Breakdown:

- Affiliate Network #1: $3,161.55

- Affiliate Network #2: $66.00

- Affiliate Network #3: $259.00

Expenses:

$3,150.00

Traffic Source Breakdown:

- Traffic Source #1: $84.54

- Traffic Source #2: $3,065.46

Net Profit:

$336.55

Ouch.

2014 Affiliate Marketing Results

Now that I’m into my 2nd year of these affiliate marketing reports, here’s a recap of how 2013 fared for the entire year:

| Year | Gross | Expense | Net | ROI |

| 2013 | $823,884.01 | $555,024.33 | $258,859.68 | 46% |

| Total: | $823,884.01 | $555,024.33 | $258,859.68 | 46% |

| Monthly Average: | $68,657.00 | $47,085.36 | $21,571.64 | 46% |

And here’s a monthly breakdown of 2014 so far:

| Month | Gross | Expense | Net | ROI |

| January 2014 | $10,922.80 | $8,908.47 | $2,014.33 | 23% |

| February 2014 | $25,941.97 | $15,900.52 | $10,041.45 | 63% |

| March 2014 | $24,202.06 | $15,408.95 | $8,793.11 | 57% |

| April 2014 | $3,486.55 | $3,150.00 | $336.55 | 11% |

| Total: | $64,553.38 | $43,367.94 | $21,185.44 | 49% |

| Monthly Average: | $16,138.35 | $10,841.99 | $5,296.36 | 49% |

So, that hurt things…

Still though, things aren’t all that bad. Taking a look at my spreadsheet, since I started recording my numbers in January 2013, my overall average month net profit (spread across 16 months) is $17,502.82.

As I said before… when things are good, things are really good. The great months definitely more than make up for the poor months such as in this case.

Net Profit Projections

This is just a reminder that I decided to cease including my graphs for projected future numbers, as I decided that there really are no trends when it comes to affiliate marketing. It’s simply far too volatile, and so much of it is out of your control.

April Recap

So what happened?

I run a bunch of offers spread over a number of traffic sources, which are again spread over various campaigns, creative, etc.

As a result, when you see my numbers drop dramatically as they did in April, it’s almost always a result of everything going bad at once. I was dropped from a few offers, there was increased competition on some traffic networks (which caused me to pause my campaigns there entirely), and some advertisers decided to drop their rates.

So really, I basically just paused most of my stuff. I didn’t launch anything new either. Instead, I spent my time catching up on my other work.

May Plans and Predictions

Normally in this section I list the plans I have for the upcoming month as well as predict how I think the month will fare profit-wise. However, since May has already come and gone, I will be skipping this section in this report since I already know how it went.

I will probably publish May’s affiliate marketing income report around 10-12 days from now (with other posts inbetween) since I’m only one report behind now. And this time, there’s no hint as to how May performed. You’ll just have to stay tuned…

An In-Depth Look at BoxOfAds

June 26, 2014 Posted by Tyler CruzI had kept hearing about an ad spy service called BoxOfAds amongst the affiliate marketing crowd for a while now and finally decided to try them out about a month ago.

My campaigns were starting to become a little bit stagnant and I wanted to try something new to get some fresh ideas and keep things alive and kicking.

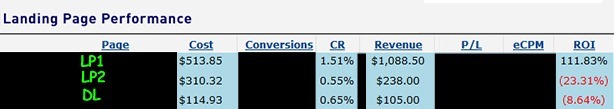

Within about an hour of looking into BoxOfAds, I found a couple of landing pages that looked like they had the potential to do well, and took them, made a few small modifications and improvements here and there to match my offers, and split-test them against a direct link (the control).

The results were as follows:

While the 2nd landing page converted at slightly less than the direct link, the first landing page ended up tripling the conversion rate, yielding an ROI of over 100%.

The beauty of this is that this landing page can be used for eternity across future campaigns by simply modifying it for each offer and angle, so the value discovered here is in some ways limitless.

About a month after finding this landing page, I can thank BoxOfAds for around $5,000 to $10,000 net profit (I run hundreds of campaigns a month so I don’t know exactly) as a simple result of finding these landing pages.

Now, BoxOfAds isn’t just about finding landing pages. You can find the exact traffic sources of your competitors, right down to the publisher level. You can even see their collection of ad creative used, countries targeted, tracking links, and more.

Watch My 37-Minute Screencast Walkthrough

Below is a 37-minute screencast I made showing how BoxOfAds works and what it offers. It is available up to 1080 HD, so I recommend watching in HD full screen if you want to see everything properly.:

(Note: You may need to visit the post directly at TylerCruz.com if you’re reading this via e-mail or RSS in order to see it.)

One thing I forgot to mention in my screencast is that BoxOfAds is going to be adding international data into their system (as it currently is only for US) for the PPV Pro Package within the next 2 weeks.

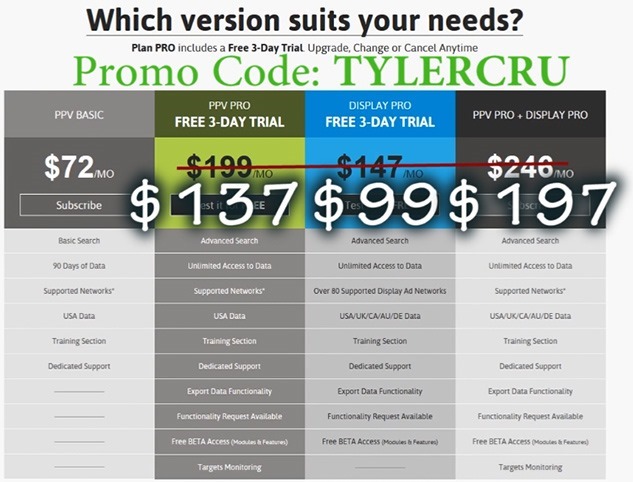

Get a Lifetime Discount

The owner of BoxOfAds was kind enough to offer my readers a lifetime membership discount. They are as follows:

- PPV Pro:

$199/month$137/month - Display Pro:

$147/month$99/month - Combo :

$246/month$197/month

Be sure to enter the promo code: TYLERCRU when signing up. That’s with no Z on the end (8 character limit…), so be careful ![]()

Free 1-on-1 Skype Training from the Owner

The owner of BoxOfAds, Luke Jasiak, has also offered free one-on-one training/consulting via Skype to the first 2 people who order the combo package with my promo code.

Here’s a good way to learn the system and get advice, tips, strategies on analyzing competitors.

So there you have it. I’ve been very happy with BoxOfAds so far.

Simply signing up to the system won’t make turn your unprofitable campaigns profitable though. It’s all about applying the information you find there and using it to your advantage.

Get ideas such as themes and angles and apply them to your ad creative and landing pages. Find new traffic sources right down to the publisher level (Ad Network –> Publisher).

See what other affiliates are doing and either copy them or better yet, improve on them.